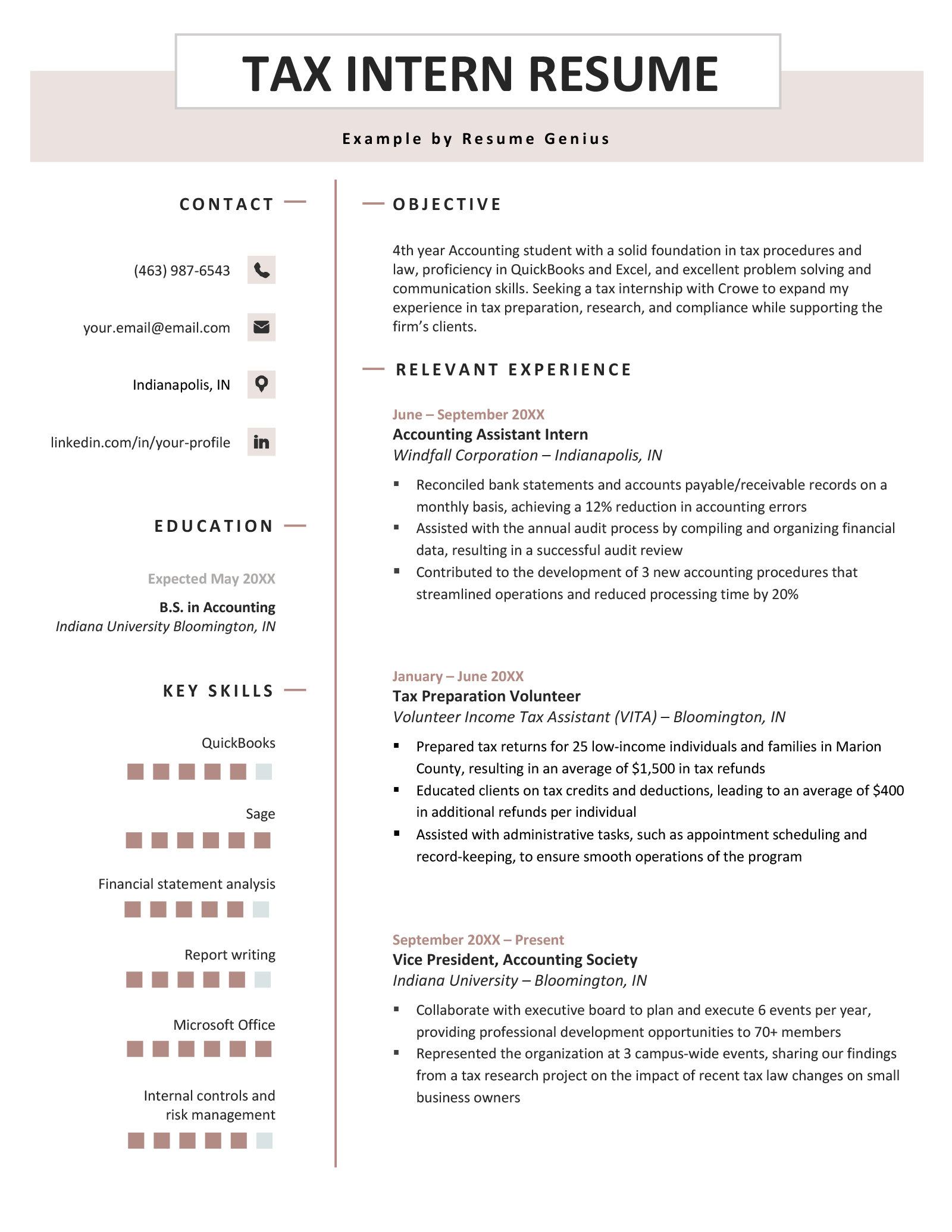

Tax Intern Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Objective

4th year Accounting student with a solid foundation in tax procedures and law, proficiency in QuickBooks and Excel, and excellent problem solving and communication skills. Seeking a tax internship with Crowe to expand my experience in tax preparation, research, and compliance while supporting the firm’s clients.

Relevant Experience

Accounting Assistant Intern

Windfall Corporation – Indianapolis, IN

June – September 2022

- Reconciled bank statements and accounts payable/receivable records on a monthly basis, achieving a 12% reduction in accounting errors

- Assisted with the annual audit process by compiling and organizing financial data, resulting in a successful audit review

- Contributed to the development of 3 new accounting procedures that streamlined operations and reduced processing time by 20%

Tax Preparation Volunteer

Volunteer Income Tax Assistant (VITA) – Bloomington, IN

January – June 2022

- Prepared tax returns for 25 low-income individuals and families in Marion County, resulting in an average of $1,500 in tax refunds

- Educated clients on tax credits and deductions, leading to an average of $400 in additional refunds per individual

- Assisted with administrative tasks, such as appointment scheduling and record-keeping, to ensure smooth operations of the program

Vice President, Accounting Society

Indiana University – Bloomington, IN

September 2021 – Present

- Collaborate with executive board to plan and execute 6 events per year, providing professional development opportunities to 70+ members

- Represented the organization at 3 campus-wide events, sharing our findings from a tax research project on the impact of recent tax law changes on small business owners

Education

B.S. in Accounting

Indiana University Bloomington, IN

Expected May 2023

Key Skills

- QuickBooks

- Sage

- Financial statement analysis

- Report writing

- Microsoft Office

- Internal controls and risk management