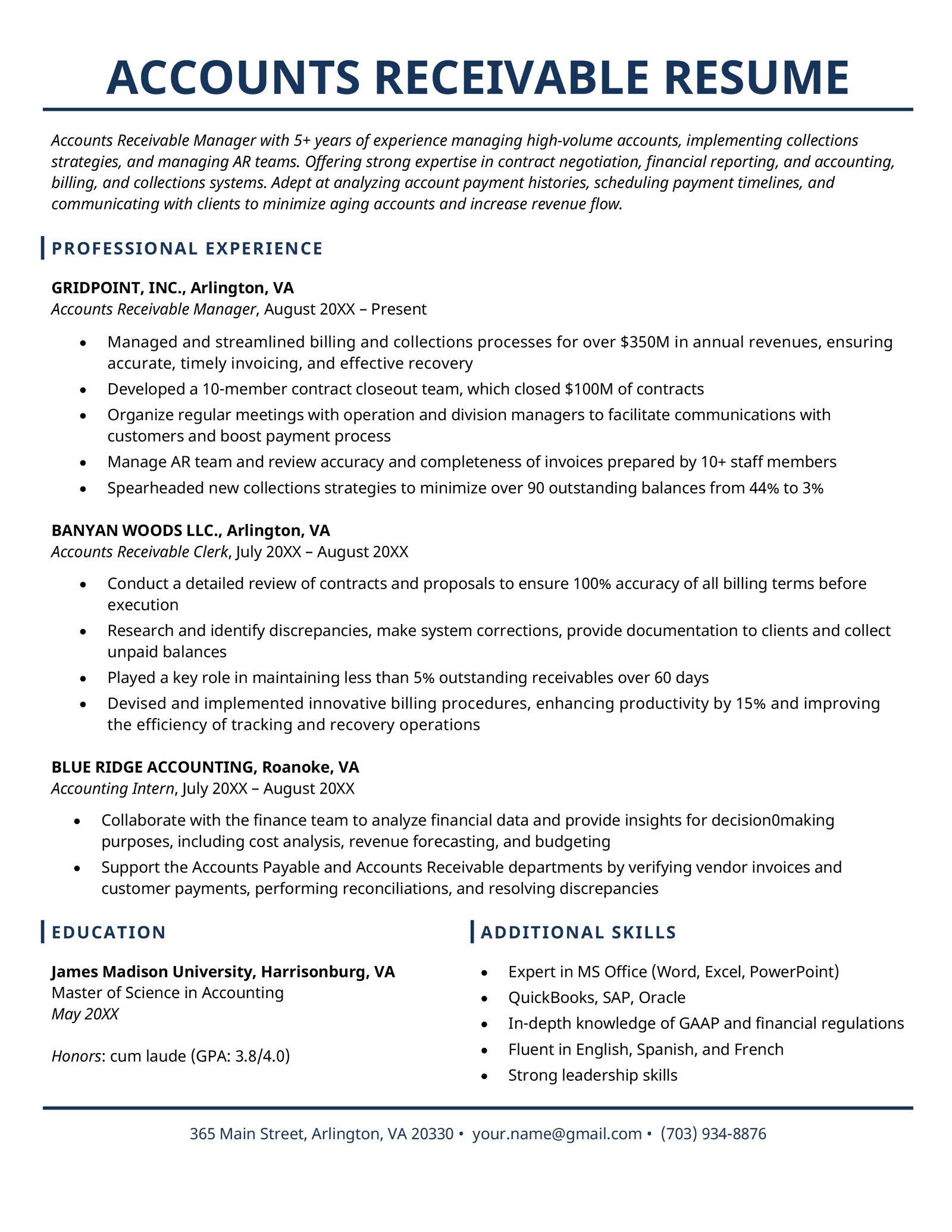

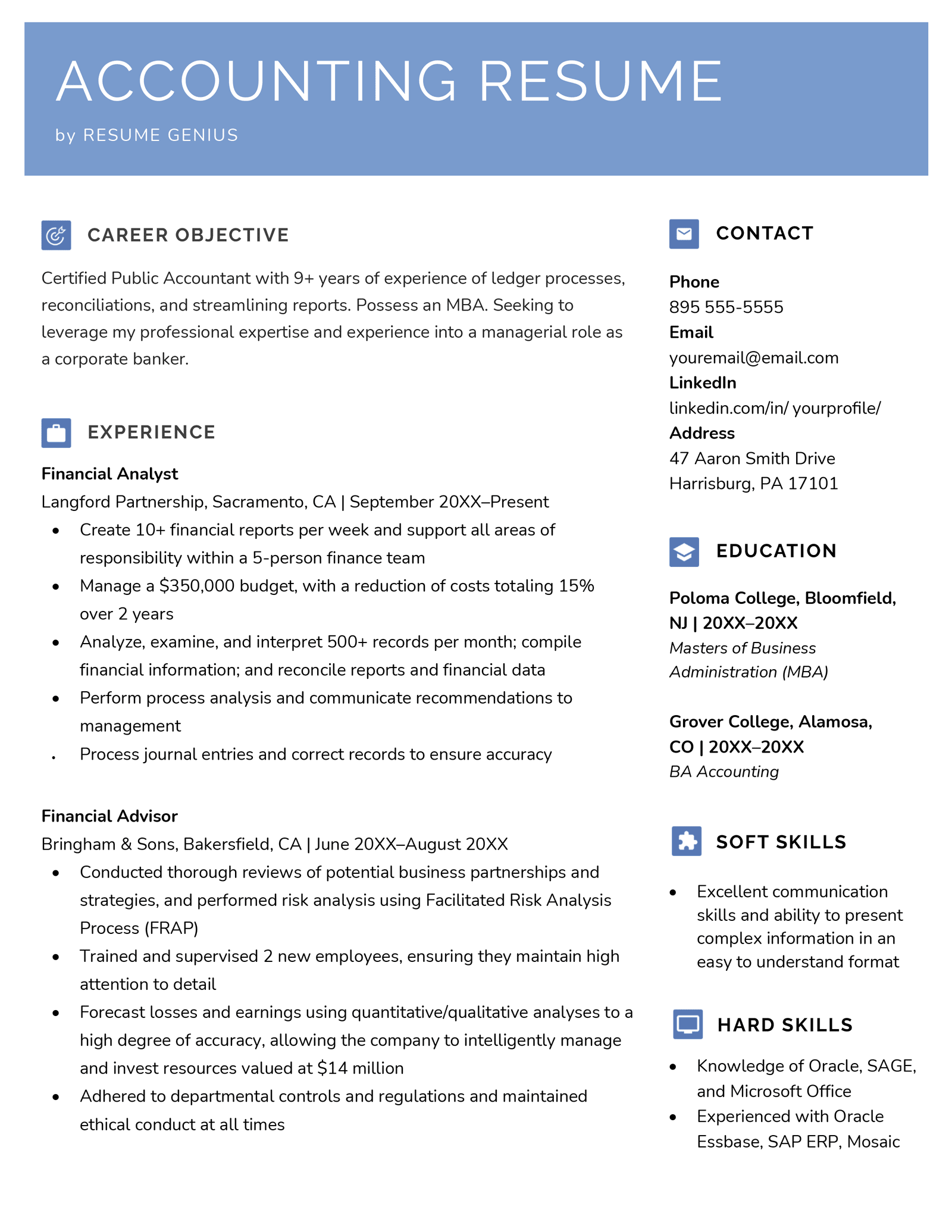

Accounts Receivable Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Summary

Accounts Receivable Manager with 5+ years of experience managing high-volume accounts, implementing collections strategies, and managing AR teams. Offering strong expertise in contract negotiation, financial reporting, and accounting, billing, and collections systems. Adept at analyzing account payment histories, scheduling payment timelines, and communicating with clients to minimize aging accounts and increase revenue flow.

Professional Experience

GRIDPOINT, INC., Arlington, VA

Accounts Receivable Manager, August 2020 – Present

- Managed and streamlined billing and collections processes for over $350M in annual revenues, ensuring accurate, timely invoicing, and effective recovery

- Developed a 10-member contract closeout team, which closed $100M of contracts

- Organize regular meetings with operation and division managers to facilitate communications with customers and boost payment process

- Manage AR team and review accuracy and completeness of invoices prepared by 10+ staff members

- Spearheaded new collections strategies to minimize over 90 outstanding balances from 44% to 3%

BANYAN WOODS LLC., Arlington, VA

Accounts Receivable Clerk, July 2017 – August 2020

- Conduct a detailed review of contracts and proposals to ensure 100% accuracy of all billing terms before execution

- Research and identify discrepancies, make system corrections, provide documentation to clients and collect unpaid balances

- Played a key role in maintaining less than 5% outstanding receivables over 60 days

- Devised and implemented innovative billing procedures, enhancing productivity by 15% and improving the efficiency of tracking and recovery operations

- Facilitated migration of a legacy system to Costpoint while working with a project setup team to ensure the accurate set up of contracts

BLUE RIDGE ACCOUNTING, Roanoke, VA

Accounting Intern, July 2016 – August 2017

- Collaborate with the finance team to analyze financial data and provide insights for decision0making purposes, including cost analysis, revenue forecasting, and budgeting

- Support the Accounts Payable and Accounts Receivable departments by verifying vendor invoices and customer payments, performing reconciliations, and resolving discrepancies

Education

James Madison University, Harrisonburg, VA

Master of Science in Accounting

May 2016

Honors: cum laude (GPA: 3.8/4.0)

Additional Skills

- Expert in MS Office (Word, Excel, PowerPoint)

- QuickBooks, SAP, Oracle

- In-depth knowledge of GAAP and financial regulations

- Fluent in English, Spanish, and French

- Strong leadership skills