Debt Collector Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

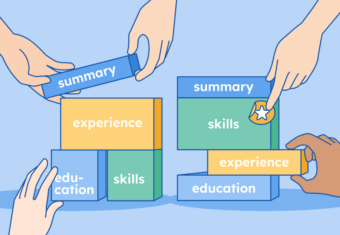

Career Objective

Goal-oriented, bilingual (Spanish/English) professional Debt Collector with 7+ years of experience working for debt collection agencies. Results-driven multitasker with excellent listening and communication skills. Comprehensive knowledge of relevant FDCPA legal requirements, and highly skilled in negotiating and resolving conflicts.

Professional Experience

April 2017–Present | Intuit, Los Angeles, CA

Collections, AHC, Legal Inquiries Risk Management

- Process and analyze 30+ exception cases per week quickly and accurately

- Communicate complex issues in an easily understandable way to customers both verbally and in writing

- Perform 50+ daily outbound calls to customers and other financial institutions

- File lawsuits before the debt passes its statute of limitations if legal action is necessary

- Answer incoming calls in order to reduce customer complaints and maintain 90% customer satisfaction

- Collect past due balances, make payment arrangements, post payments, and finalize settlements in a timely manner

August 2015-March 2017 | Ganahl Lumber Co, Torrance, CA

Credit Collector

- Collected accounts receivable in a polite yet firm manner to avoid receiving cease and desist letters, increasing profits by 10% within two years

- Processed and followed up on 70+ non-sufficient fund (NSF) checks, set up 60+ job accounts, and posted 75+ customer accounts monthly

- Negotiated payment plans and payoff deadlines to ensure timely payments

- Sent 60+ validation notices per week within 5 days of first contact

- Registered paperwork and performed office duties to promote efficiency

Education

Technology and Information Management

May 2015

UC Santa Cruz, Santa Cruz, California

Honors: cum laude

(GPA: 3.6/4.0)

Relevant Skills

- DataArc360

- Metro2 Format

- Microsoft Word

- Microsoft Excel

- Customer relationship management

- Bilingual in Spanish and English