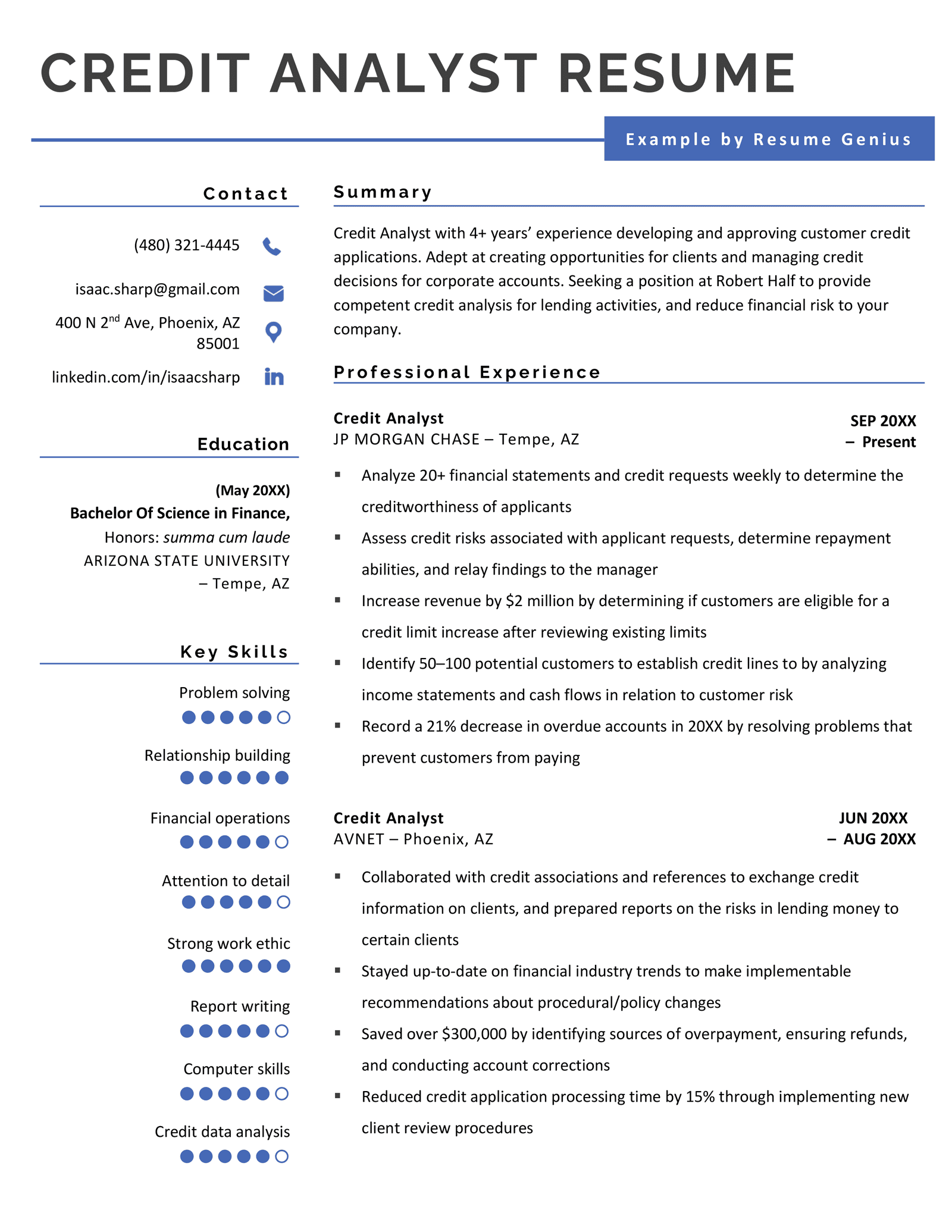

Credit Analyst Resume Template (Text Format)

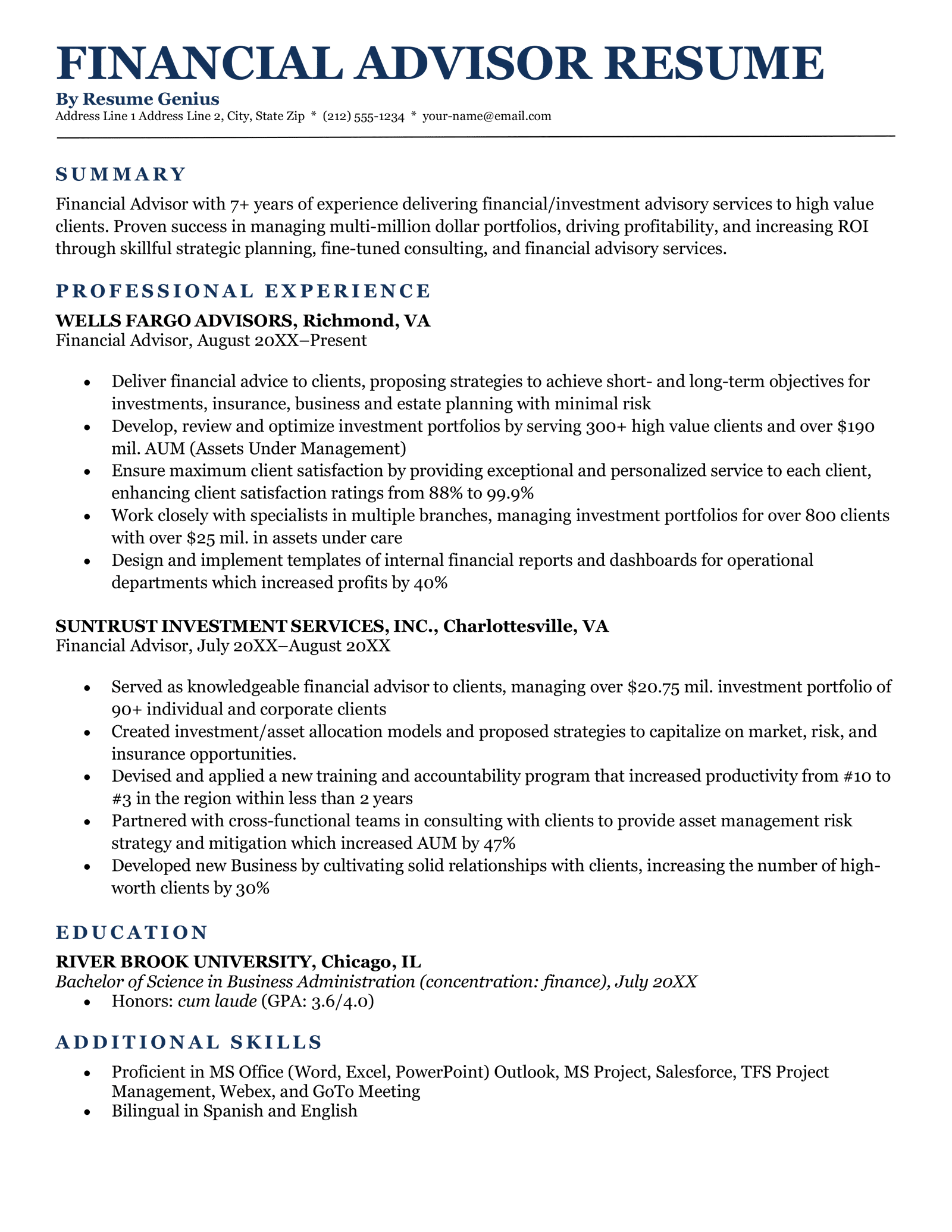

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Summary

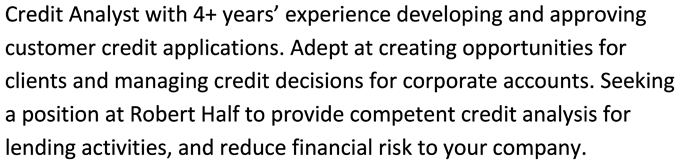

Credit Analyst with 4+ years’ experience developing and approving customer credit applications. Adept at creating opportunities for clients and managing credit decisions for corporate accounts. Seeking a position at Robert Half to provide competent credit analysis for lending activities, and reduce financial risk to your company.

Professional Experience

JP MORGAN CHASE – Tempe, AZ

Credit Analyst, September 2020 – Present

- Analyze 20+ financial statements and credit requests weekly to determine the creditworthiness of applicants

- Assess credit risks associated with applicant requests, determine repayment abilities, and relay findings to the manager

- Increase revenue by $2 million by determining if customers are eligible for a credit limit increase after reviewing existing limits

- Identify 50–100 potential customers to establish credit lines to by analyzing income statements and cash flows in relation to customer risk

- Record a 21% decrease in overdue accounts in 2021 by resolving problems that prevent customers from paying

AVNET – Phoenix, AZ

Credit Analyst, June 2018 – August 2020

- Collaborated with credit associations and references to exchange credit information on clients, and prepared reports on the risks in lending money to certain clients

- Stayed up-to-date on financial industry trends to make implementable recommendations about procedural/policy changes

- Saved over $300,000 by identifying sources of overpayment, ensuring refunds, and conducting account corrections

- Reduced credit application processing time by 15% through implementing new client review procedures

Education

ARIZONA STATE UNIVERSITY – Tempe, AZ

Bachelor Of Science in Finance, May 2018

- Honors: summa cum laude

Key Skills

- Problem solving

- Relationship building

- Financial operations

- Attention to detail

- Strong work ethic

- Report writing

- Computer skills

- Credit data analysis