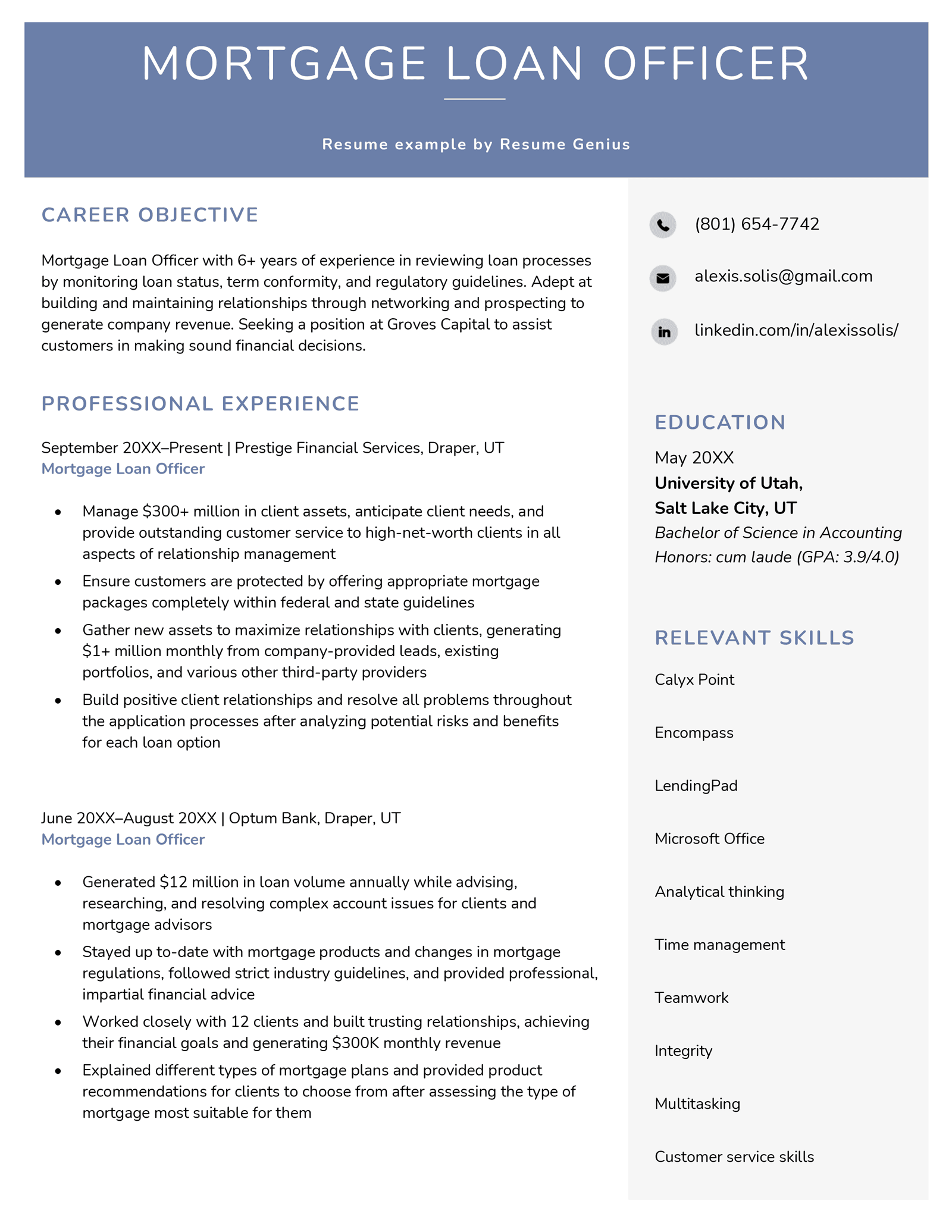

Mortgage Loan Officer Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Career Objective

Mortgage Loan Officer with 6+ years of experience in reviewing loan processes by monitoring loan status, term conformity, and regulatory guidelines. Adept at building and maintaining relationships through networking and prospecting to generate company revenue. Seeking a position at Groves Capital to assist customers in making sound financial decisions.

Professional Experience

Prestige Financial Services, Draper, UT

Mortgage Loan Officer, September 2019–Present

- Manage $300+ million in client assets, anticipate client needs, and provide outstanding customer service to high-net-worth clients in all aspects of relationship management

- Ensure customers are protected by offering appropriate mortgage packages completely within federal and state guidelines

- Gather new assets to maximize relationships with clients, generating $1+ million monthly from company-provided leads, existing portfolios, and various other third-party providers

- Build positive client relationships and resolve all problems throughout the application processes after analyzing potential risks and benefits for each loan option

Optum Bank, Draper, UT

Mortgage Loan Officer, June 2016–August 2019

- Generated $12 million in loan volume annually while advising, researching, and resolving complex account issues for clients and mortgage advisors

- Stayed up to-date with mortgage products and changes in mortgage regulations, followed strict industry guidelines, and provided professional, impartial financial advice

- Worked closely with 12 clients and built trusting relationships, achieving their financial goals and generating $300K monthly revenue

- Explained different types of mortgage plans and provided product recommendations for clients to choose from after assessing the type of mortgage most suitable for them

Education

University of Utah, Salt Lake City, UT, May 2016

Bachelor of Science in Accounting

- Honors: cum laude (GPA: 3.9/4.0)

Relevant Skills

- Calyx Point

- Encompass

- LendingPad

- Microsoft Office

- Analytical thinking

- Time management

- Teamwork

- Integrity

- Multitasking

- Customer service skills