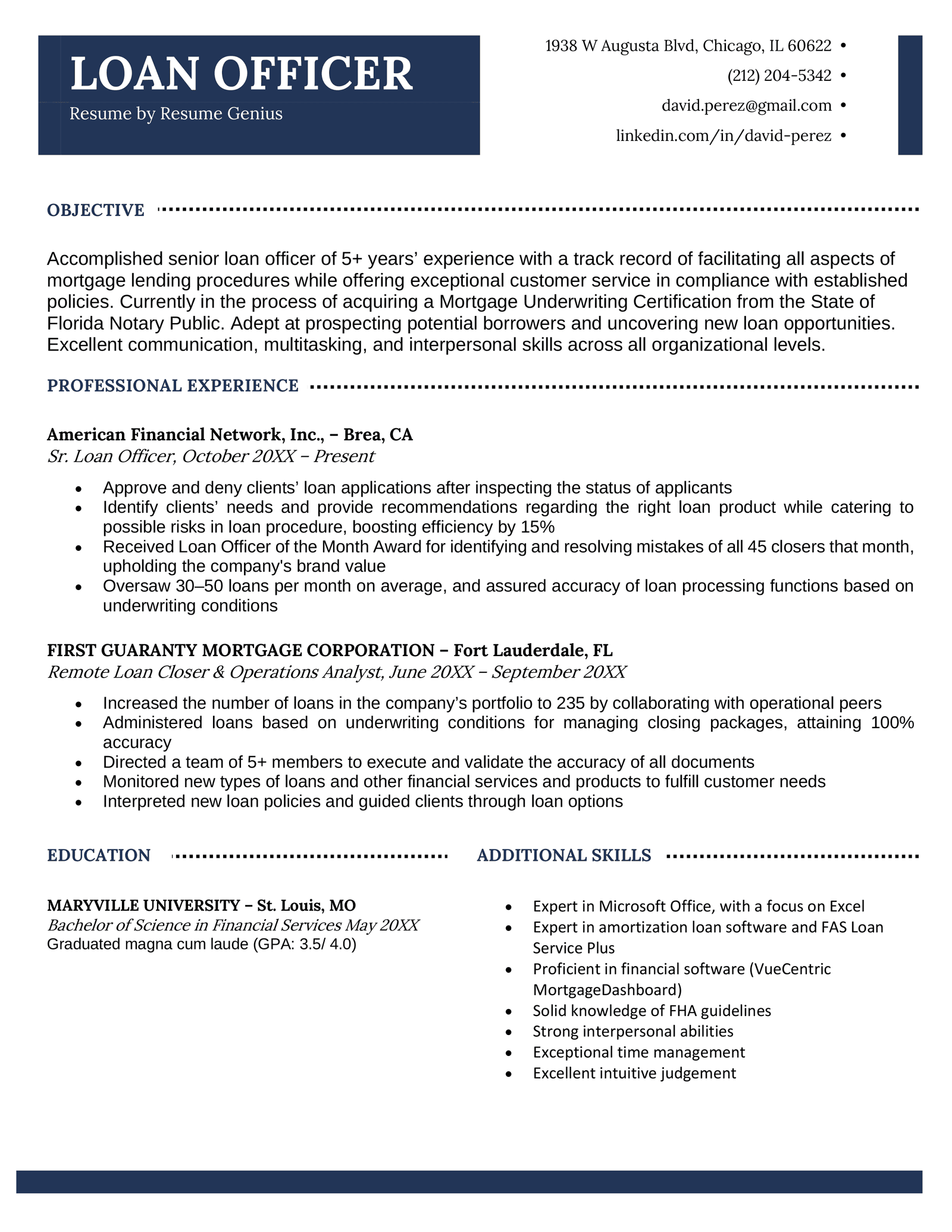

Loan Officer Resume Template (Text Format)

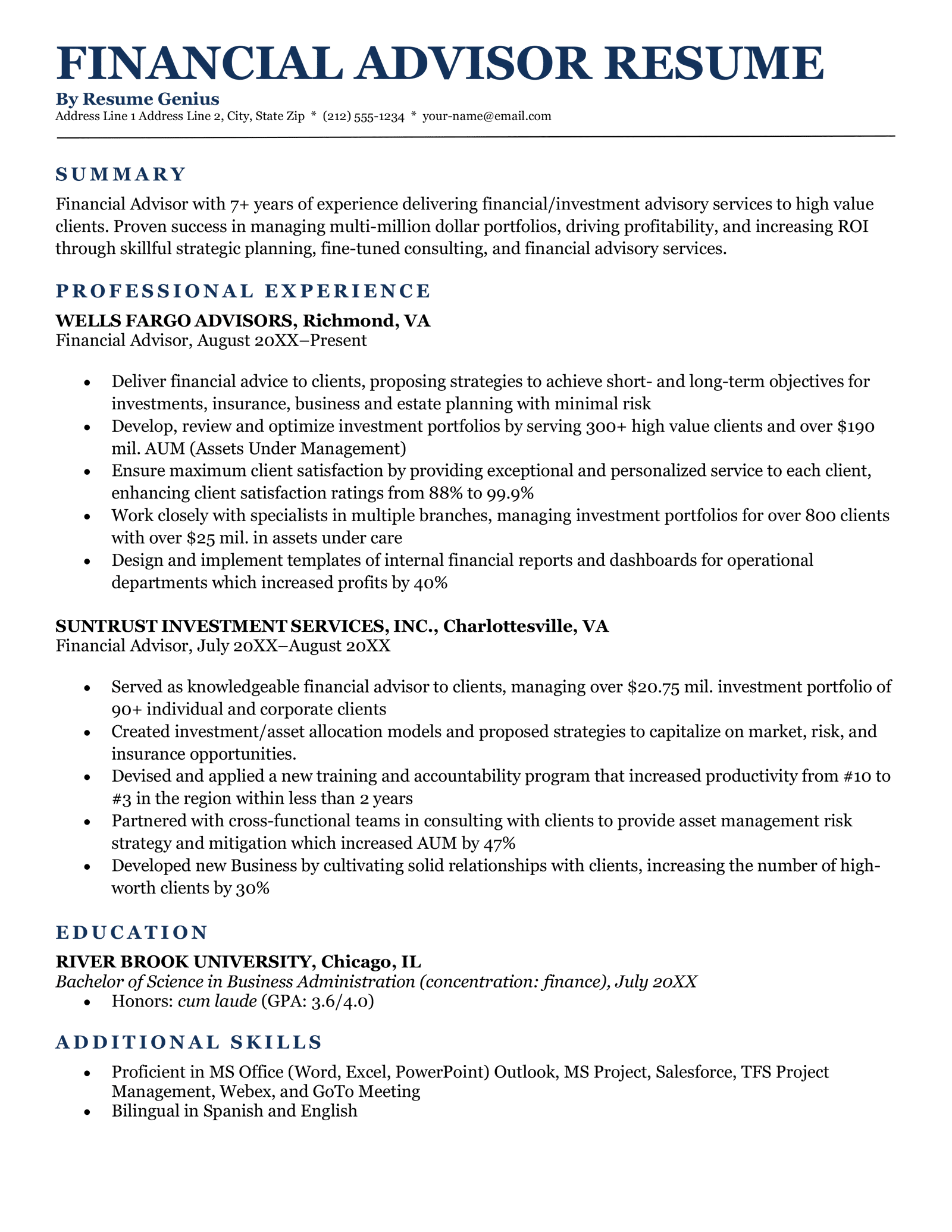

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Objective

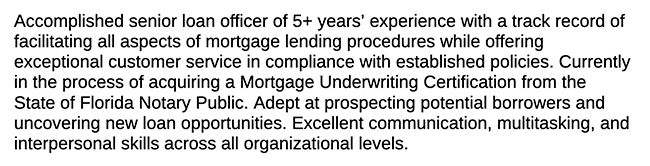

Accomplished senior loan officer of 5+ years’ experience with a track record of facilitating all aspects of mortgage lending procedures while offering exceptional customer service in compliance with established policies. Currently in the process of acquiring a Mortgage Underwriting Certification from the State of Florida Notary Public. Adept at prospecting potential borrowers and uncovering new loan opportunities. Excellent communication, multitasking, and interpersonal skills across all organizational levels.

Professional Experience

American Financial Network, Inc., – Brea, CA

Sr. Loan Officer, October 2020 – Present

- Approve and deny clients’ loan applications after inspecting the status of applicants

- Identify clients’ needs and provide recommendations regarding the right loan product while catering to possible risks in loan procedure, boosting efficiency by 15%

- Received Loan Officer of the Month Award for identifying and resolving mistakes of all 45 closers that month, upholding the company’s brand value

- Oversaw 30–50 loans per month on average, and assured accuracy of loan processing functions based on underwriting conditions

First Guaranty Mortgage Corporation – Fort Lauderdale, FL

Remote Loan Closer & Operations Analyst, June 2017 – September 2020

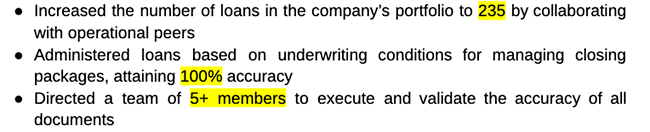

- Increased the number of loans in the company’s portfolio to 235 by collaborating with operational peers

- Administered loans based on underwriting conditions for managing closing packages, attaining 100% accuracy

- Directed a team of 5+ members to execute and validate the accuracy of all documents

- Monitored new types of loans and other financial services and products to fulfill customer needs

- Interpreted new loan policies and guided clients through loan options

Education

Maryville University – St. Louis, MO

Bachelor of Science in Financial Services May 2017

Graduated magna cum laude (GPA: 3.5/ 4.0)

Additional Skills

- Expert in Microsoft Office, with a focus on Excel

- Expert in amortization loan software and FAS Loan

- Service Plus

- Proficient in financial software (VueCentric MortgageDashboard)

- Solid knowledge of FHA guidelines

- Strong interpersonal abilities

- Excellent time management skills