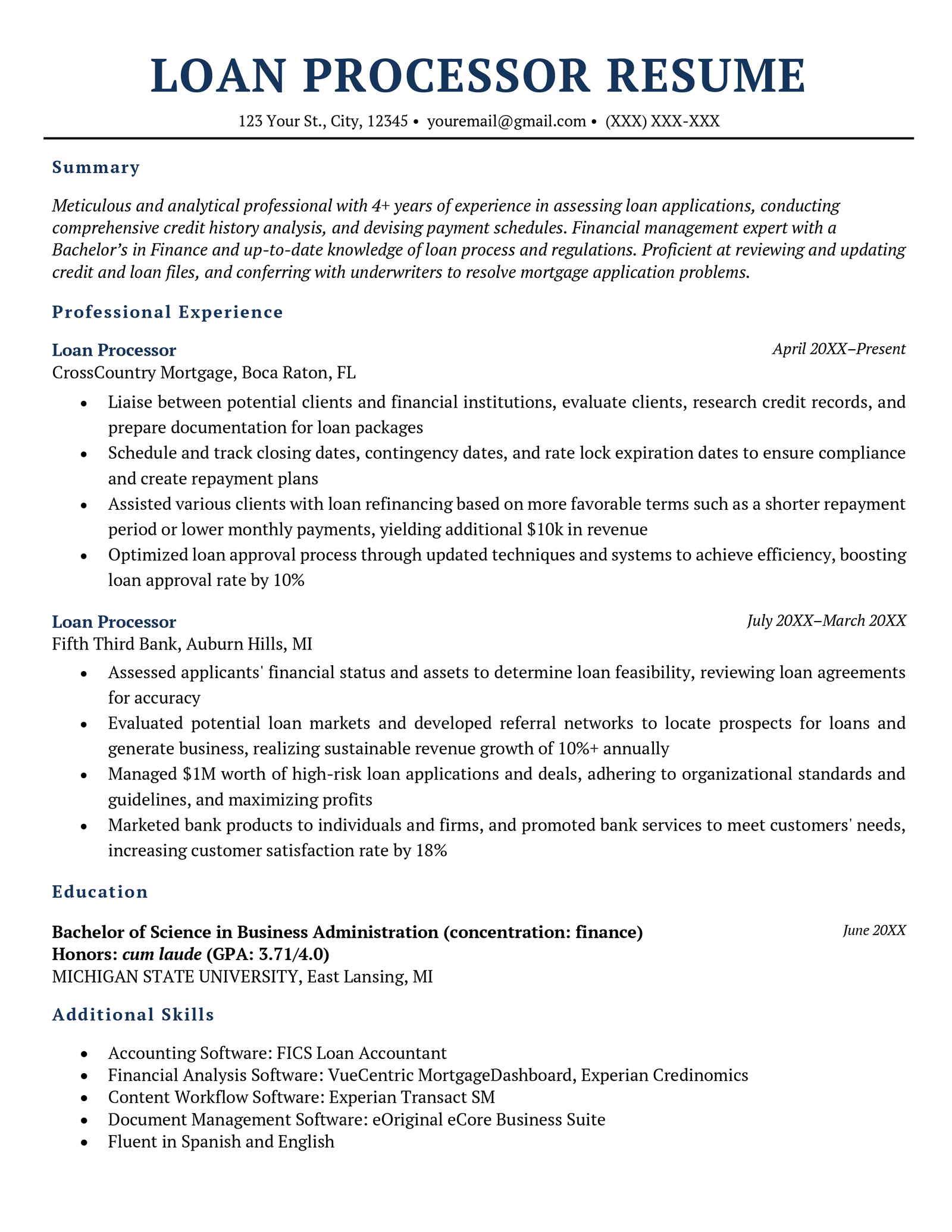

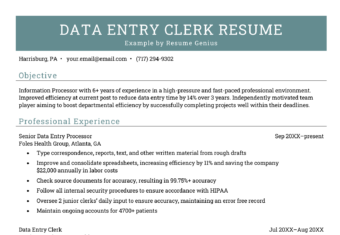

Loan Processor Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

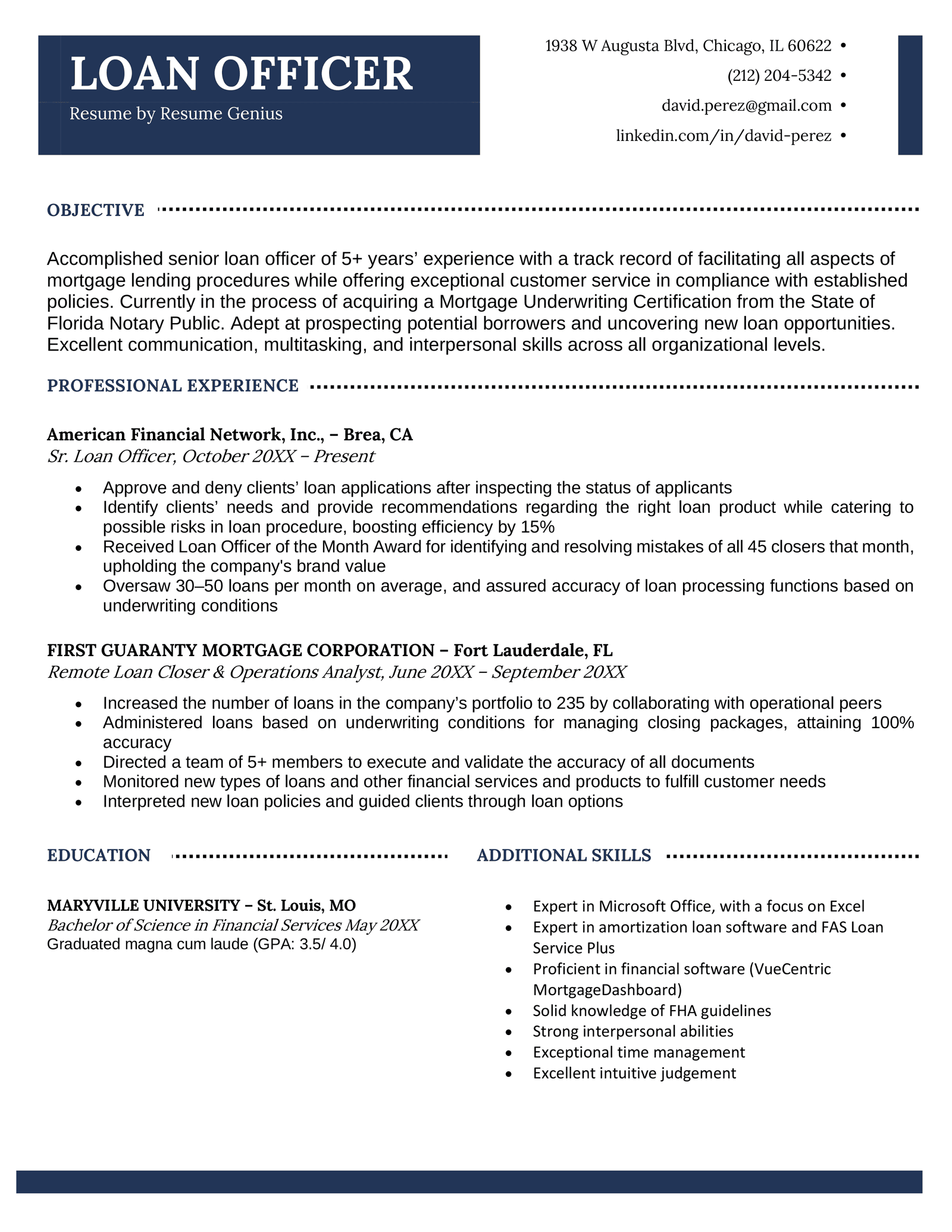

Resume Summary

Meticulous and analytical professional with 4+ years of experience in assessing loan applications, conducting comprehensive credit history analysis, and devising payment schedules. Financial management expert with a Bachelor’s in Finance and up-to-date knowledge of loan process and regulations. Proficient at reviewing and updating credit and loan files, and conferring with underwriters to resolve mortgage application problems.

Professional Experience

Loan Processor

CrossCountry Mortgage, Boca Raton, FL, April 2020–Present

- Liaise between potential clients and financial institutions, evaluate clients, research credit records, and prepare documentation for loan packages

- Schedule and track closing dates, contingency dates, and rate lock expiration dates to ensure compliance and create repayment plans

- Assisted various clients with loan refinancing based on more favorable terms such as a shorter repayment period or lower monthly payments, yielding additional $10k in revenue

- Optimized loan approval process through updated techniques and systems to achieve efficiency, boosting loan approval rate by 10%

Loan Processor

Fifth Third Bank, Auburn Hills, MI, July 2018–March 2020

- Assessed applicants’ financial status and assets to determine loan feasibility, reviewing loan agreements for accuracy

- Evaluated potential loan markets and developed referral networks to locate prospects for loans and generate business, realizing sustainable revenue growth of 10%+ annually

- Managed $1M worth of high-risk loan applications and deals, adhering to organizational standards and guidelines, and maximizing profits

- Marketed bank products to individuals and firms, and promoted bank services to meet customers’ needs, increasing customer satisfaction rate by 18%

Education

Bachelor of Science in Business Administration (concentration: Finance)

June 2018

Honors: cum laude (GPA: 3.71/4.0)

Michigan State University, East Lansing, MI

Additional Skills

- Accounting Software: FICS Loan Accountant

- Financial Analysis Software: VueCentric MortgageDashboard, Experian Credinomics

- Content Workflow Software: Experian Transact SM

- Document Management Software: eOriginal eCore Business Suite

- Fluent in Spanish and English