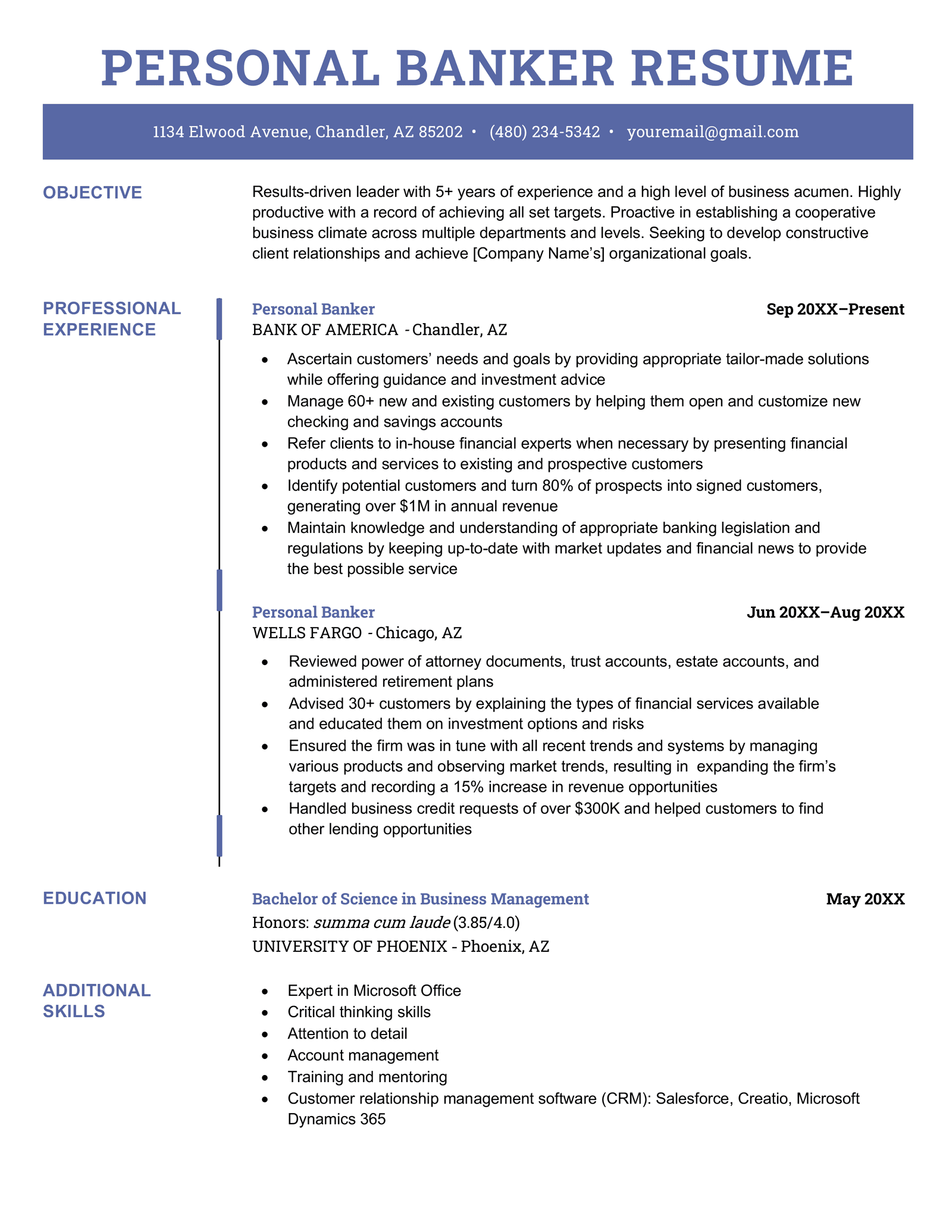

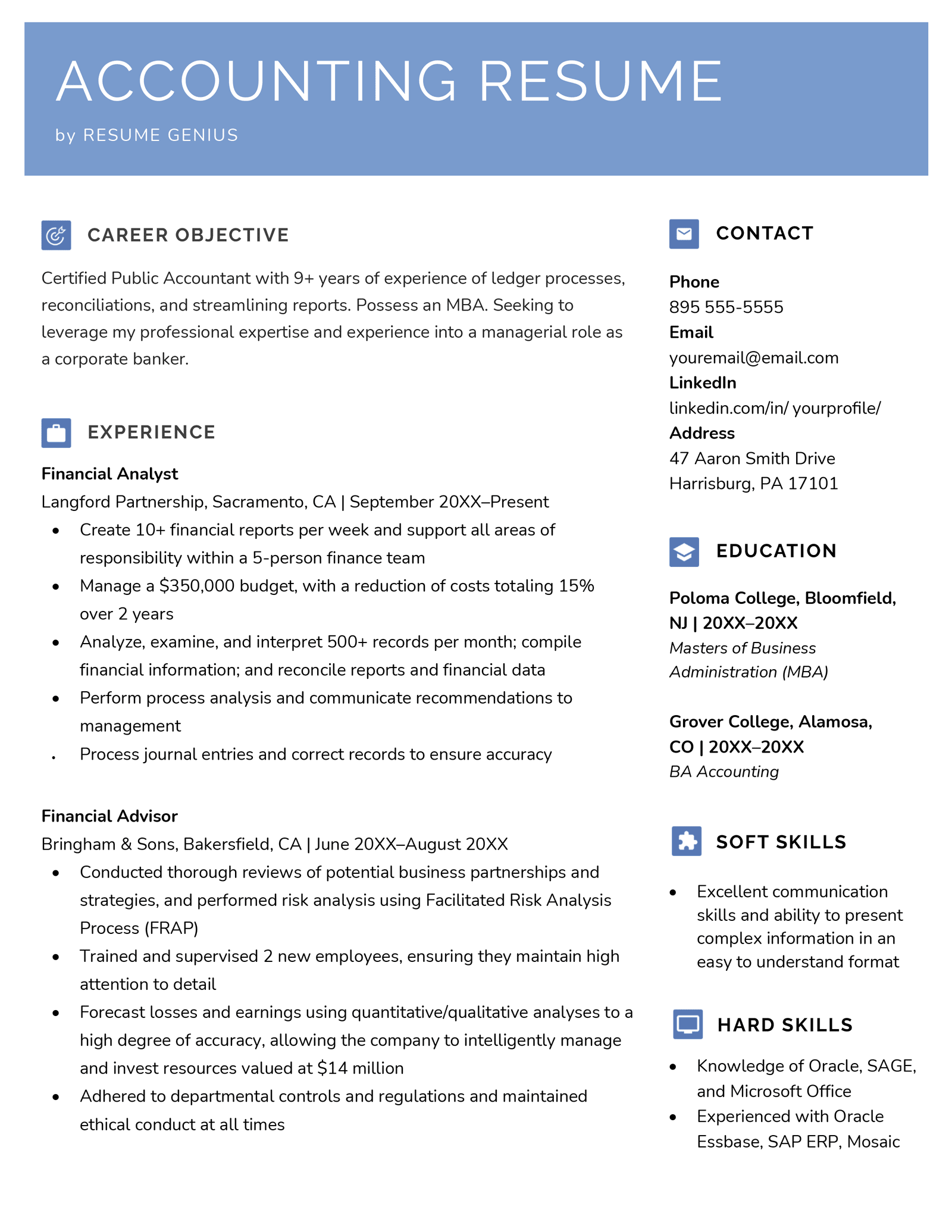

Personal Banker Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Objective

Results-driven leader with 5+ years of experience and a high level of business acumen. Highly productive with a record of achieving all set targets. Proactive in establishing a cooperative business climate across multiple departments and levels. Seeking to develop constructive client relationships and achieve [Company Name’s] organizational goals.

Professional Experience

- Ascertain customers’ needs and goals by providing appropriate tailor-made solutions while offering guidance and investment advice

- Manage 60+ new and existing customers by helping them open and customize new checking and savings accounts

- Refer clients to in-house financial experts when necessary by presenting financial products and services to existing and prospective customers

- Identify potential customers and turn 80% of prospects into signed customers, generating over $1M in annual revenue

- Maintain knowledge and understanding of appropriate banking legislation and regulations by keeping up-to-date with market updates and financial news to provide the best possible service

- Reviewed power of attorney documents, trust accounts, estate accounts, and administered retirement plans

- Advised 30+ customers by explaining the types of financial services available and educated them on investment options and risks

- Ensured the firm was in tune with all recent trends and systems by managing various products and observing market trends, resulting in expanding the firm’s targets and recording a 15% increase in revenue opportunities

- Handled business credit requests of over $300K and helped customers to find other lending opportunities

Education

University of Phoenix, Phoenix, AZ

Bachelor of Science in Business Management, May 2016

Honors: summa cum laude (GPA: 3.85/4.0)

Additional Skills

- Expert in Microsoft Office

- Critical thinking skills

- Attention to detail

- Account management

- Training and mentoring

- Customer relationship management software (CRM): Salesforce, Creatio, Microsoft Dynamics 365