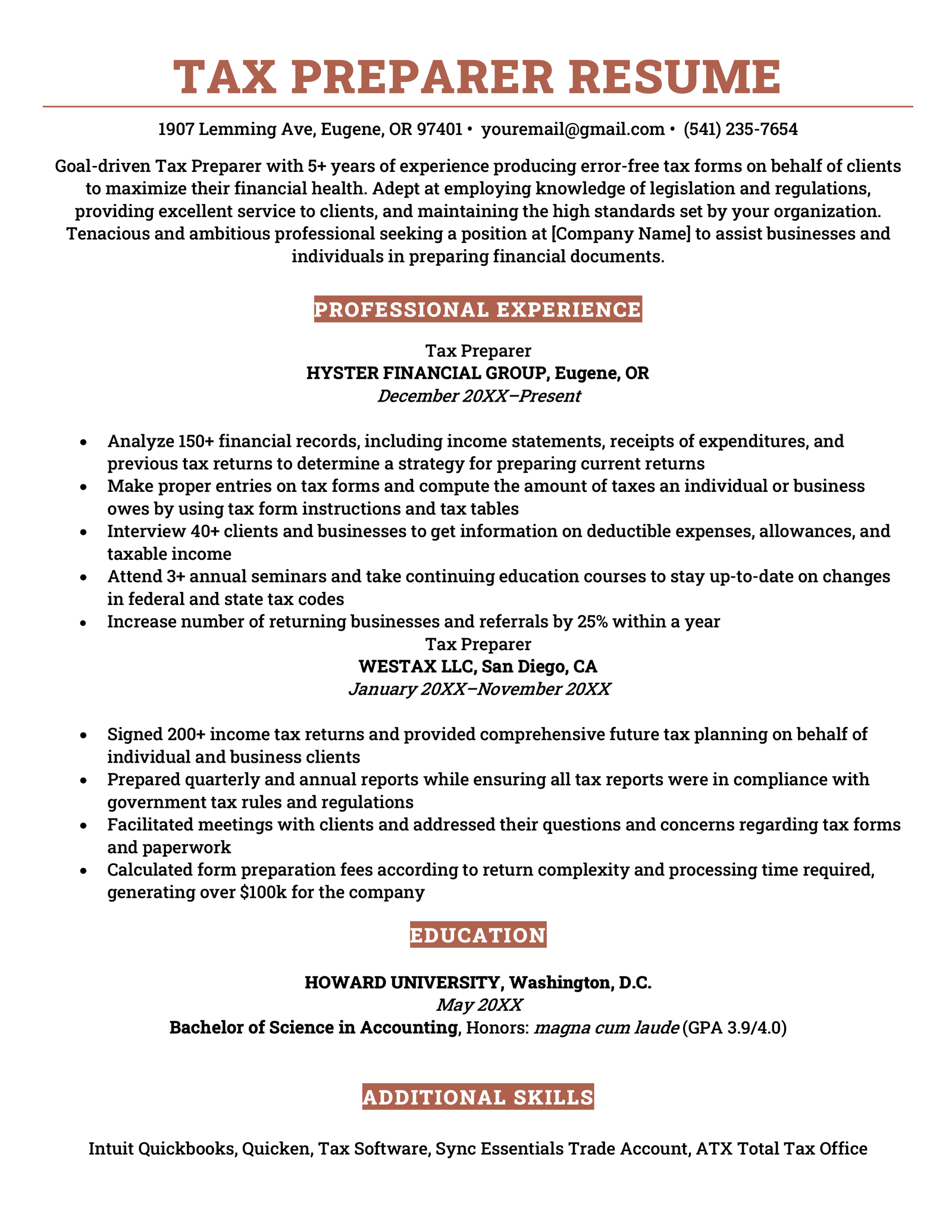

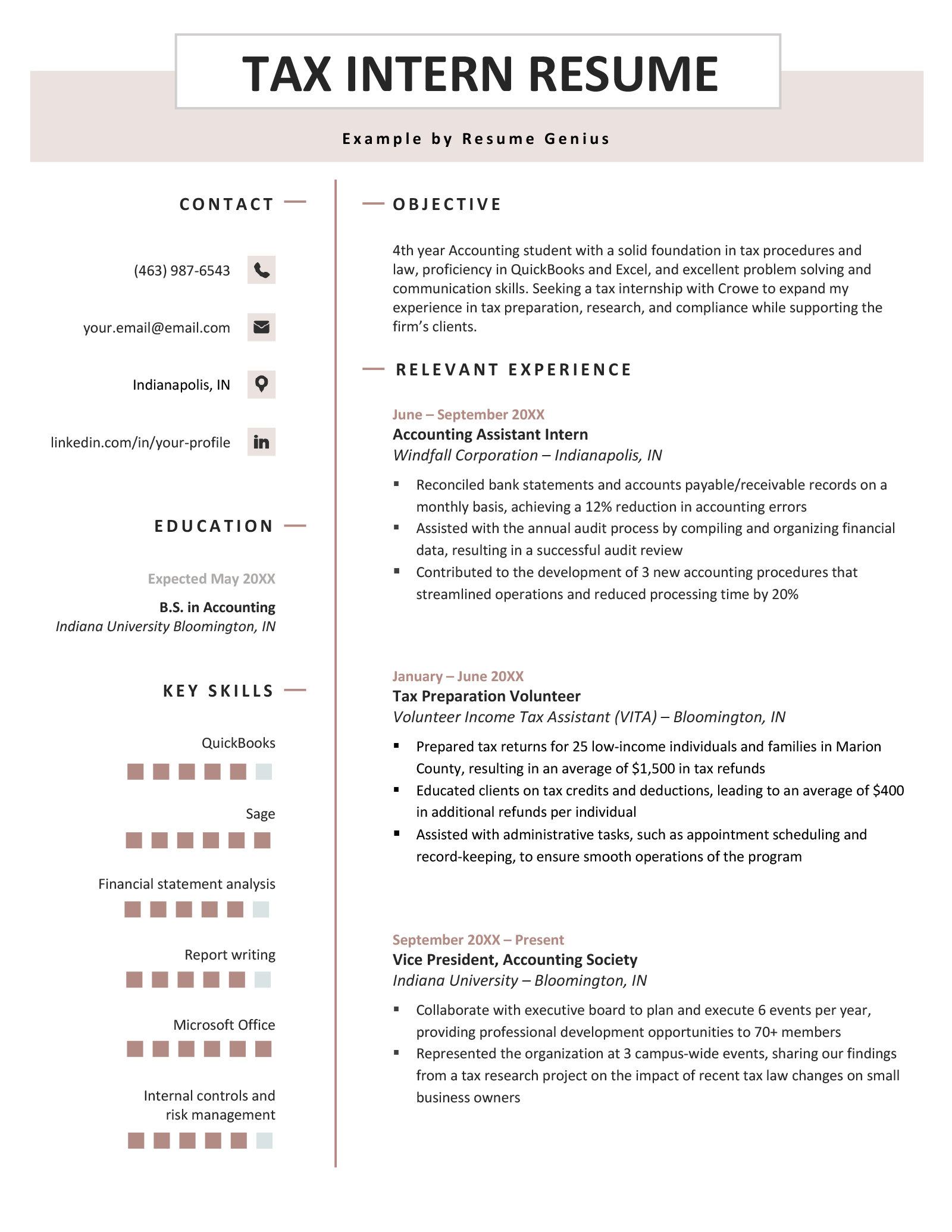

Tax Preparer Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Resume Objective

Goal-driven Tax Preparer with 5+ years of experience producing error-free tax forms on behalf of clients to maximize their financial health. Adept at employing knowledge of legislation and regulations, providing excellent service to clients, and maintaining the high standards set by your organization. Tenacious and ambitious professional seeking a position at [Company Name] to assist businesses and individuals in preparing financial documents.

Professional Experience

Tax Preparer

HYSTER FINANCIAL GROUP, Eugene, OR

December 2020–Present

- Analyze 150+ financial records, including income statements, receipts of expenditures, and previous tax returns to determine a strategy for preparing current returns

- Make proper entries on tax forms and compute the amount of taxes an individual or business owes by using tax form instructions and tax tables

- Interview 40+ clients and businesses to get information on deductible expenses, allowances, and taxable income

- Attend 3+ annual seminars and take continuing education courses to stay up-to-date on changes in federal and state tax codes

- Increase number of returning businesses and referrals by 25% within a year

Tax Preparer

WESTAX LLC, San Diego, CA

January 2019–November 2020

- Signed 200+ income tax returns and provided comprehensive future tax planning on behalf of individual and business clients

- Prepared quarterly and annual reports while ensuring all tax reports were in compliance with government tax rules and regulations

- Facilitated meetings with clients and addressed their questions and concerns regarding tax forms and paperwork

- Calculated form preparation fees according to return complexity and processing time required, generating over $100k for the company

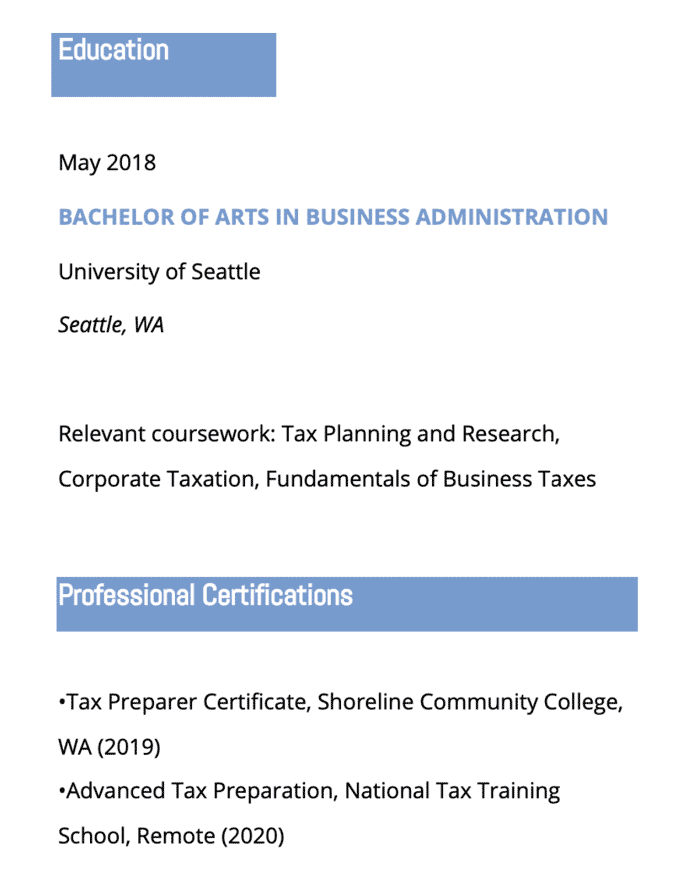

Education

HOWARD UNIVERSITY, Washington, DC

May 2017

Bachelor of Science in Accounting, Honors: magna cum laude (GPA 3.9/4.0)

Additional Skills

Intuit Quickbooks, Quicken, Tax Software, Sync Essentials Trade Account, ATX Total Tax Office