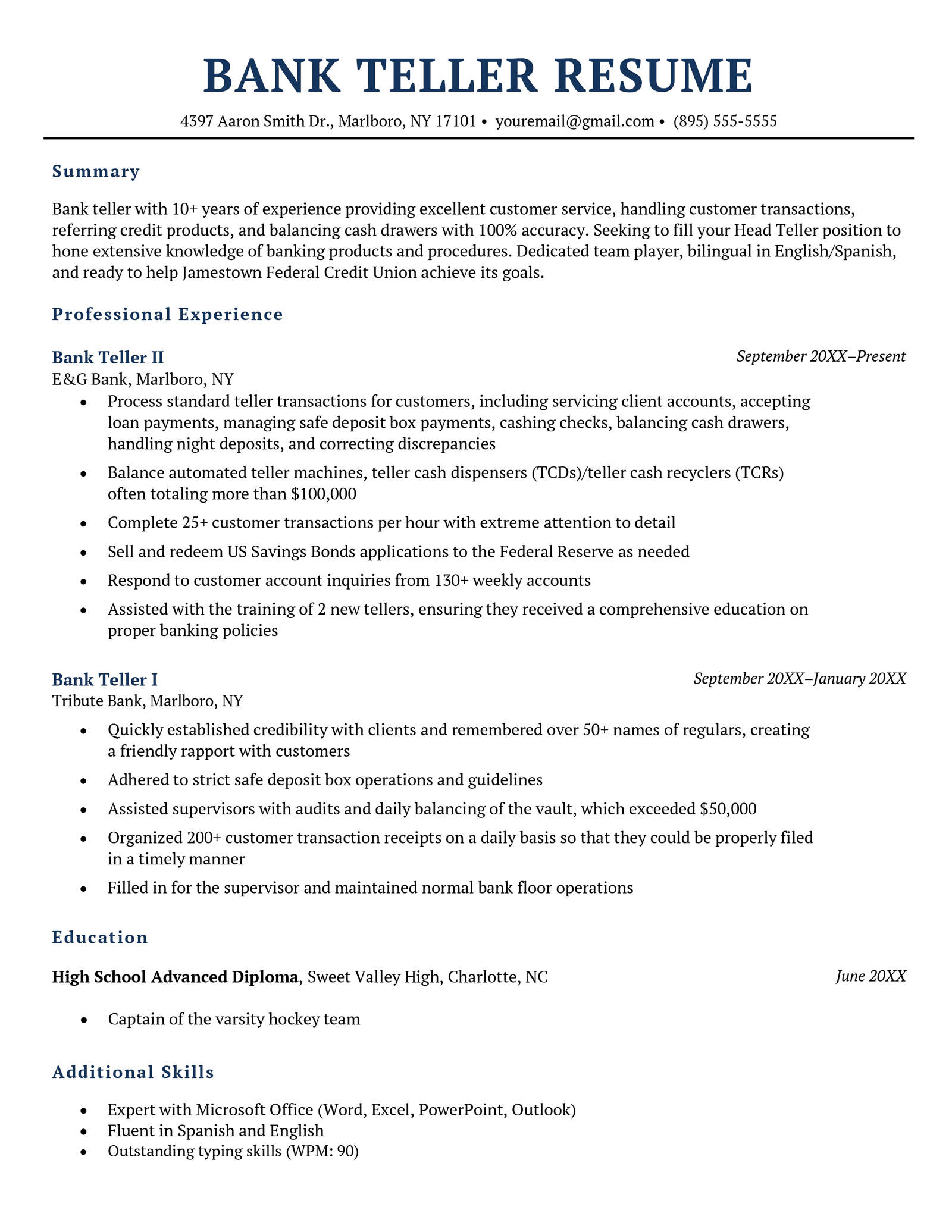

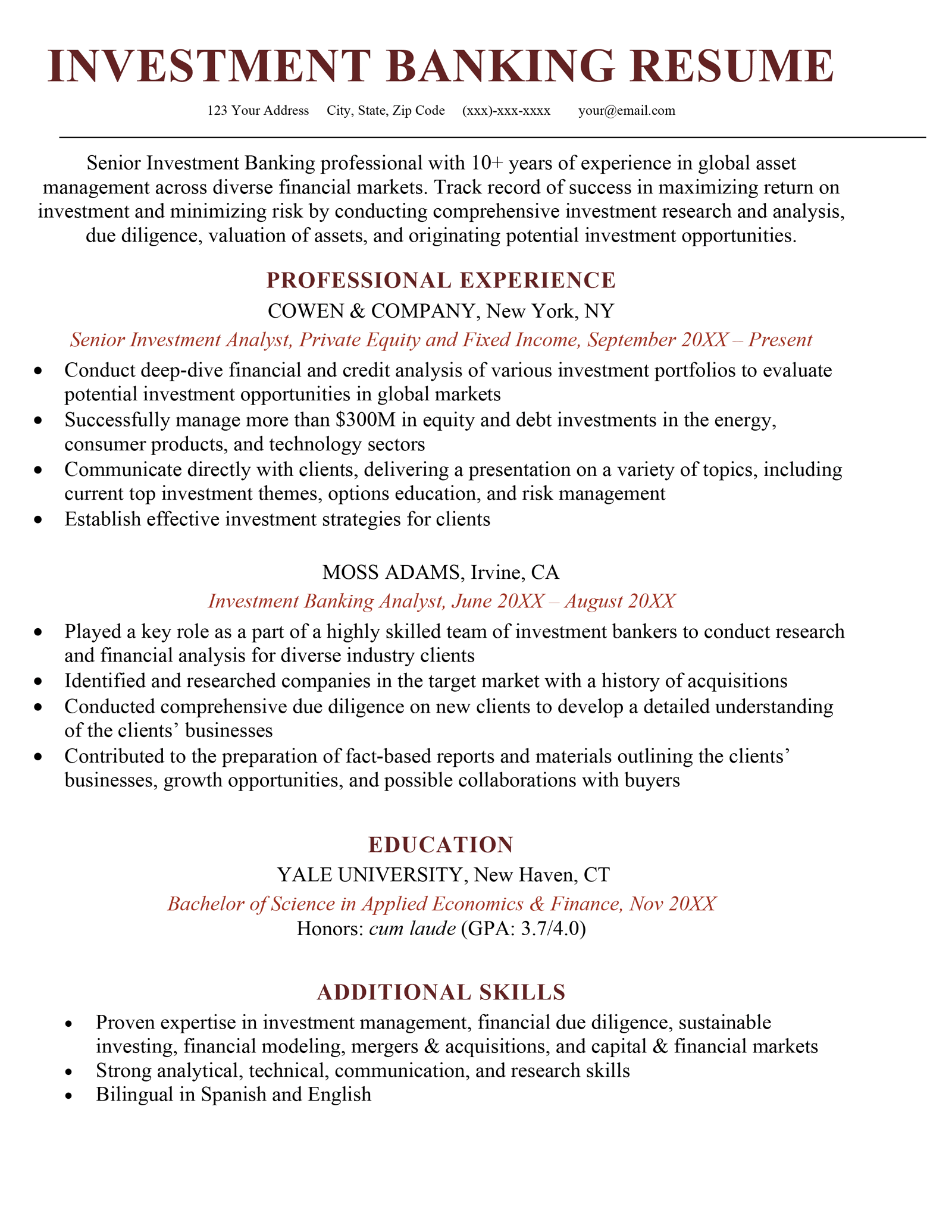

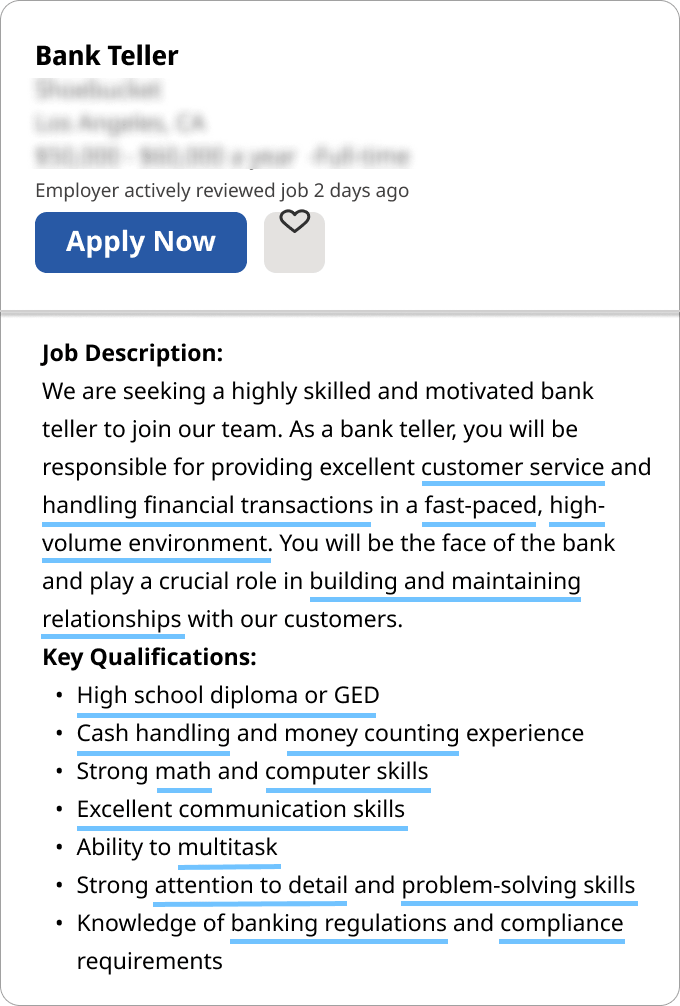

Bank Teller Resume Template (Text Format)

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Resume Summary

Bank teller with 10+ years of experience providing excellent customer service, handling customer transactions, referring credit products, and balancing cash drawers with 100% accuracy. Seeking to fill your Head Teller position to hone extensive knowledge of banking products and procedures. Dedicated team player, bilingual in English/Spanish, and ready to help Jamestown Federal Credit Union achieve its goals.

Professional Experience

- Process standard teller transactions for customers, including servicing client accounts, accepting loan payments, managing safe deposit box payments, cashing checks, balancing cash drawers, handling night deposits, and correcting discrepancies

- Balance automated teller machines, teller cash dispensers (TCDs)/teller cash recyclers (TCRs) often totaling more than $100,000

- Complete 25+ customer transactions per hour with extreme attention to detail

- Sell and redeem US Savings Bonds applications to the Federal Reserve as needed

- Respond to customer account inquiries from 130+ weekly accounts

- Assisted with the training of 2 new tellers, ensuring they received a comprehensive education on proper banking policies

- Quickly established credibility with clients and remembered over 50+ names of regulars, creating a friendly rapport with customers

- Adhered to strict safe deposit box operations and guidelines

- Assisted supervisors with audits and daily balancing of the vault, which exceeded $50,000

- Organized 200+ customer transaction receipts on a daily basis so that they could be properly filed in a timely manner

- Filled in for the supervisor and maintained normal bank floor operations

Education

High School Advanced Diploma, June 2011

- Captain of the varsity hockey team

Additional Skills

- Expert with Microsoft Office (Word, Excel, PowerPoint, Outlook)

- Fluent in Spanish and English

- Outstanding typing skills (WPM: 90)