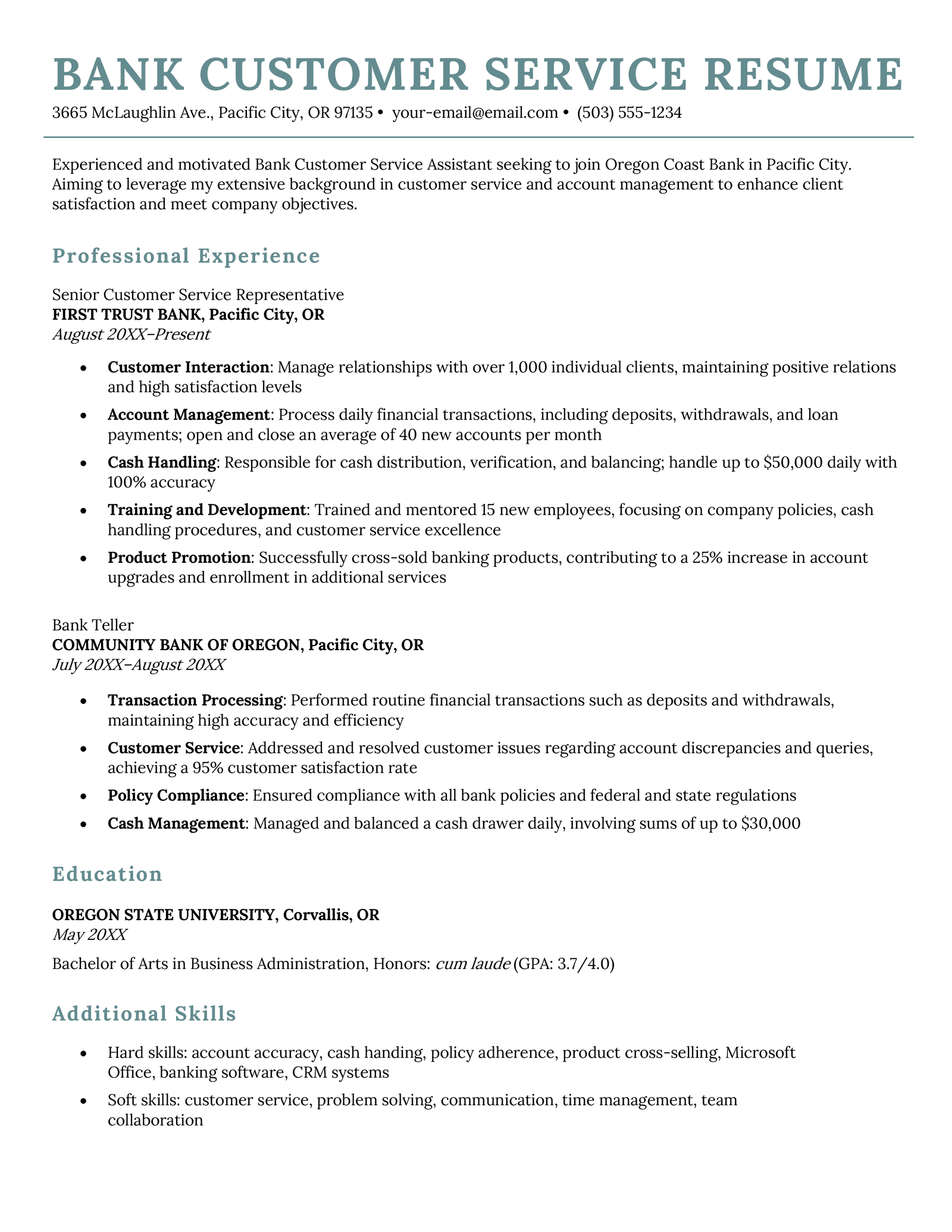

Banker Resume Template (Text Format)

First & Last Name

Email: your-name@example.com

Phone: (123) 555-1234

Address: City, State

LinkedIn: linkedin.com/in/yourprofile

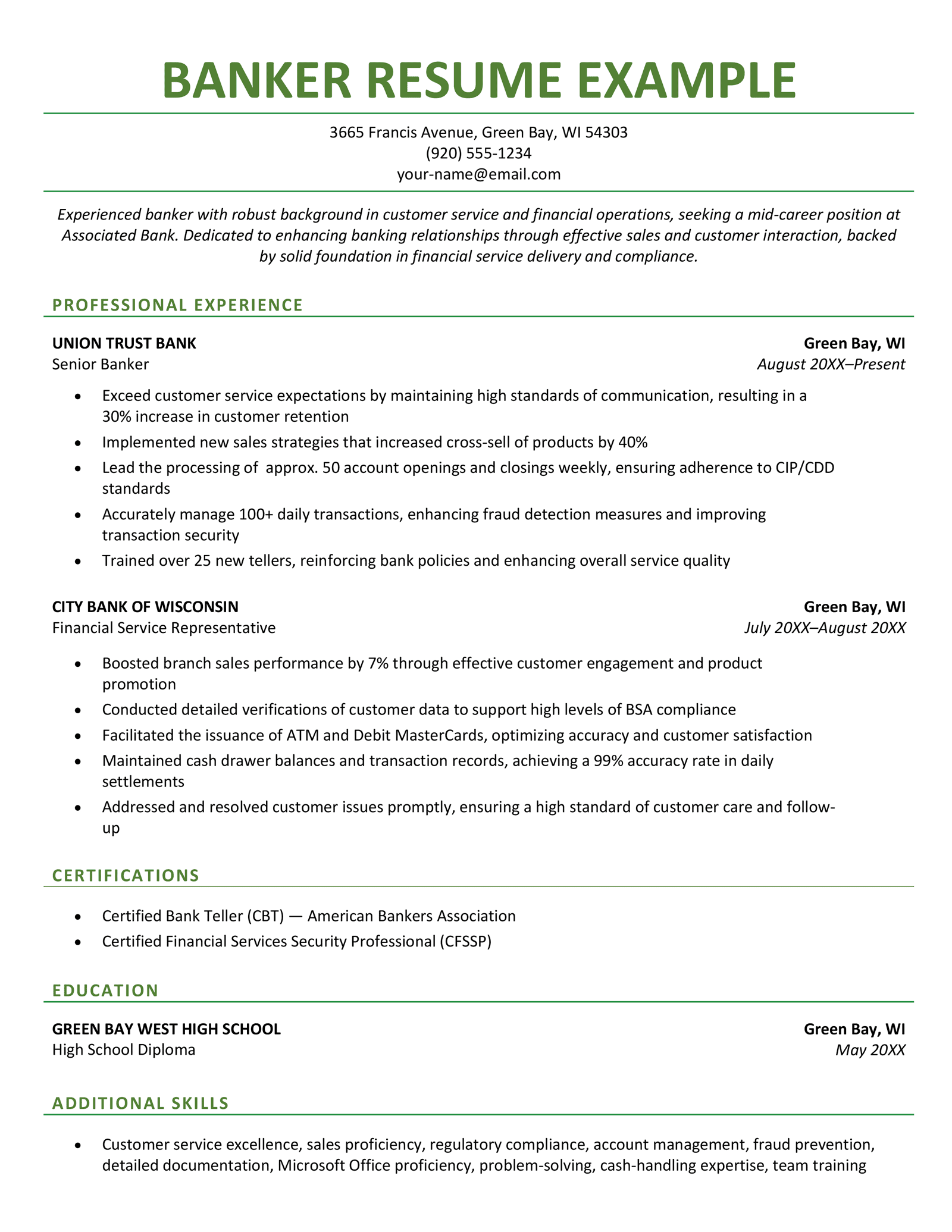

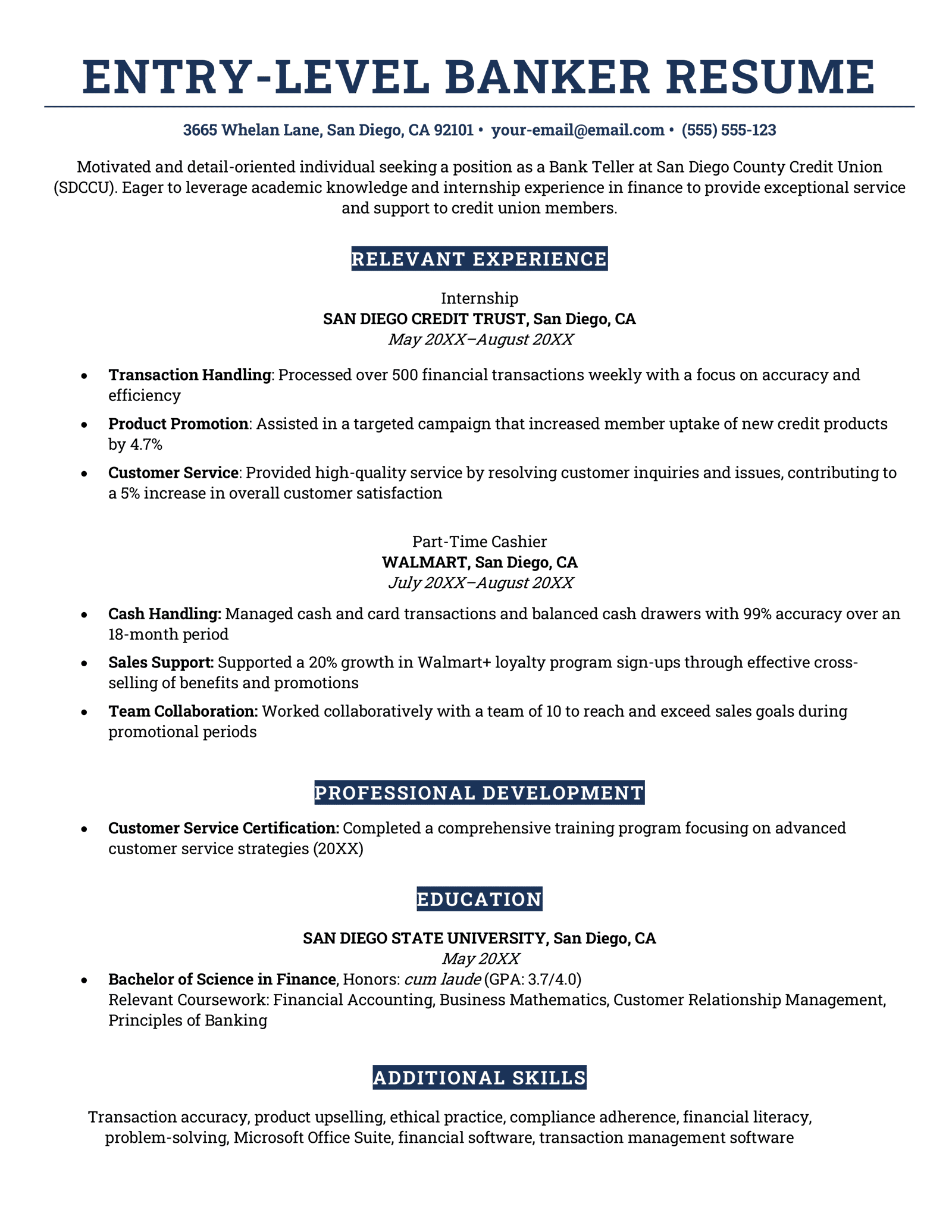

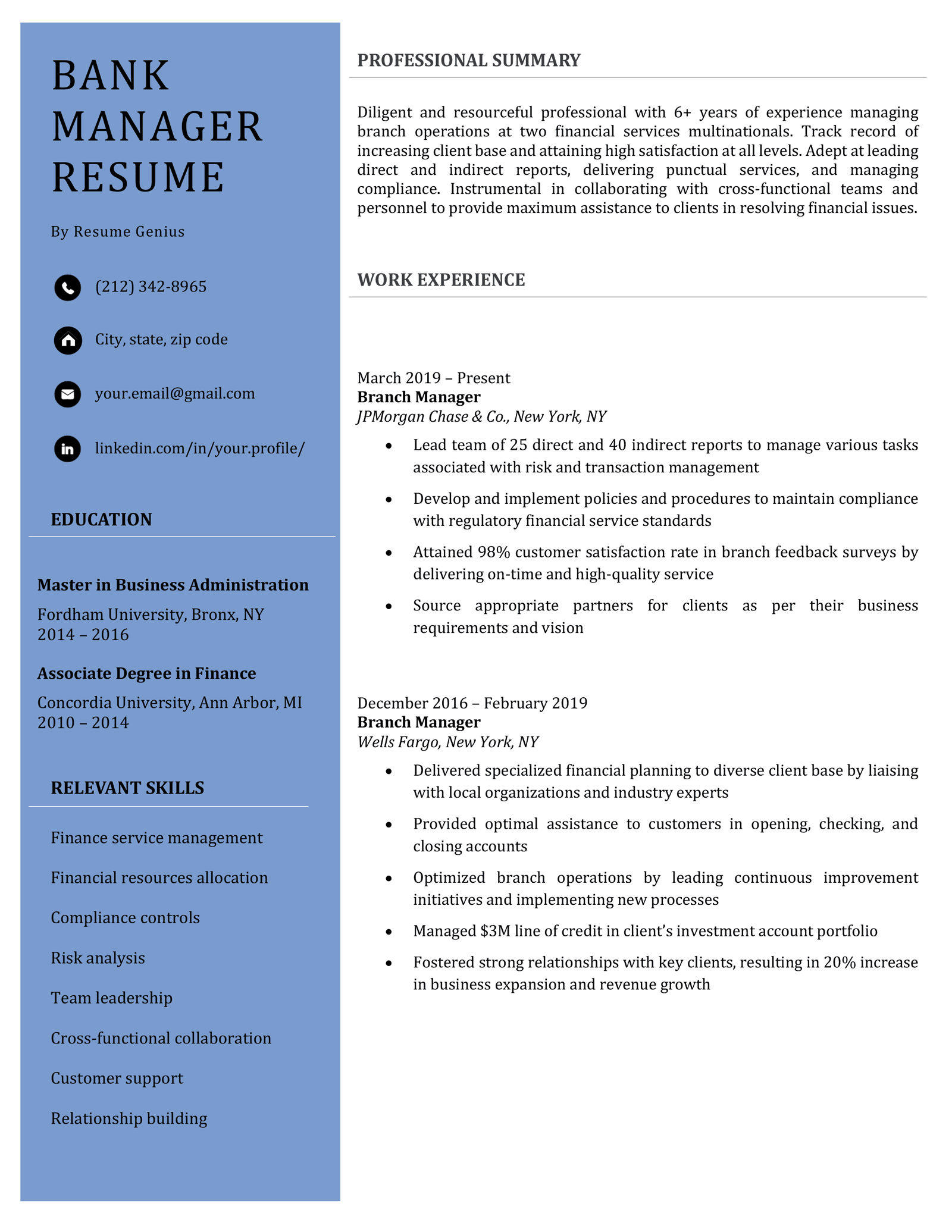

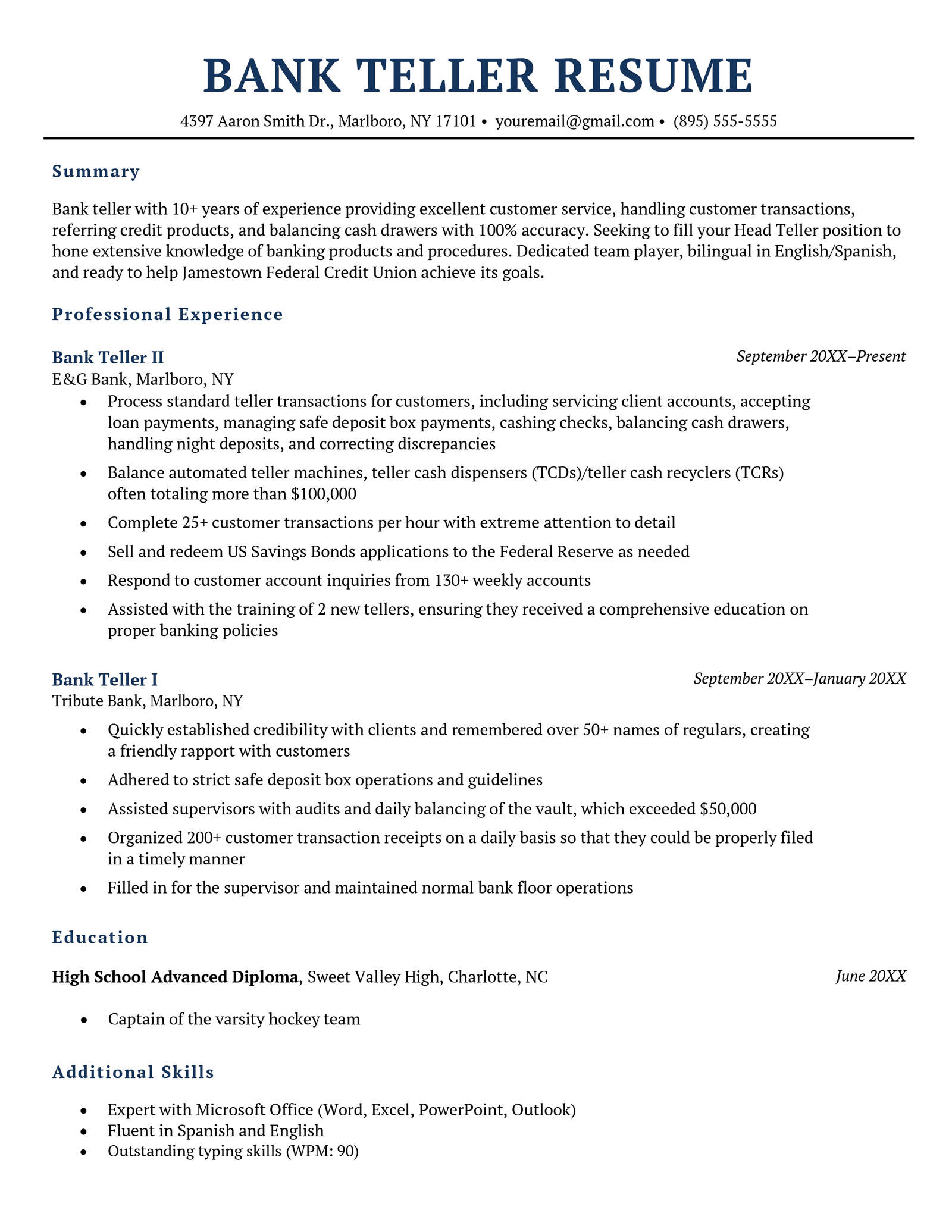

RESUME SUMMARY

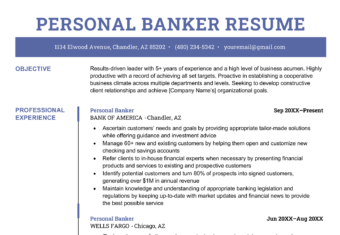

Dedicated banking professional with [no.] years of experience. Seeking to leverage my experience in [relevant abilities] to fill the Banker position at [Bank Name]. Hold a [degree/diploma/certification] in [area of study]. Skilled at [2–3 relevant skills]. A [adjective #1] and [adjective #2] worker aiming to contribute to the success of your bank.

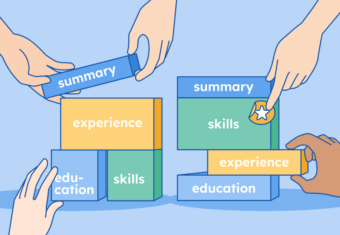

RELEVANT EXPERIENCE

- Use the present tense to describe your current banking role, unless describing a completed project or initiative

- Include a bulleted list of your achievements as a banker

- Start each bullet point with an action verb (like “develop” or “manage”) to grab attention

- Use hard numbers when possible to quantify your accomplishments as a banker

- Mention how you’ve used some of the banking and finance skills listed in your skills section to demonstrate that you really have these abilities

- List relevant accomplishments from your previous banker role

- Assuming you’re no longer working in this banking role, use past tense verbs to describe your work

- Include 3–6 bullet points for each banking-industry role you list

- Skip the pronoun “I” and begin directly with a verb

- Although you’ll usually list work experience, feel free to include banking-relevant internships as well as any volunteer work and extracurricular activities if you lack formal work experience

EDUCATION

GPA: 3.X/4.0 (optional)

Latin honors (if applicable)

SKILLS & CERTIFICATIONS

- List skills and certifications relevant to the banking job you’re applying for

- Look at the job ad for ideas of the skills the employer wants and that are common in the banking sector

- Emphasize hard/technical skills in this section

- Be as specific as possible by including names of tools, equipment, and software you’ve mastered that are used in banking

OPTIONAL RESUME SECTIONS

- Add any other relevant information about your background here

- For example, this section could be used to highlight any of the following information: banker-relevant awards, publications, or coursework, as well as languages and volunteer experience