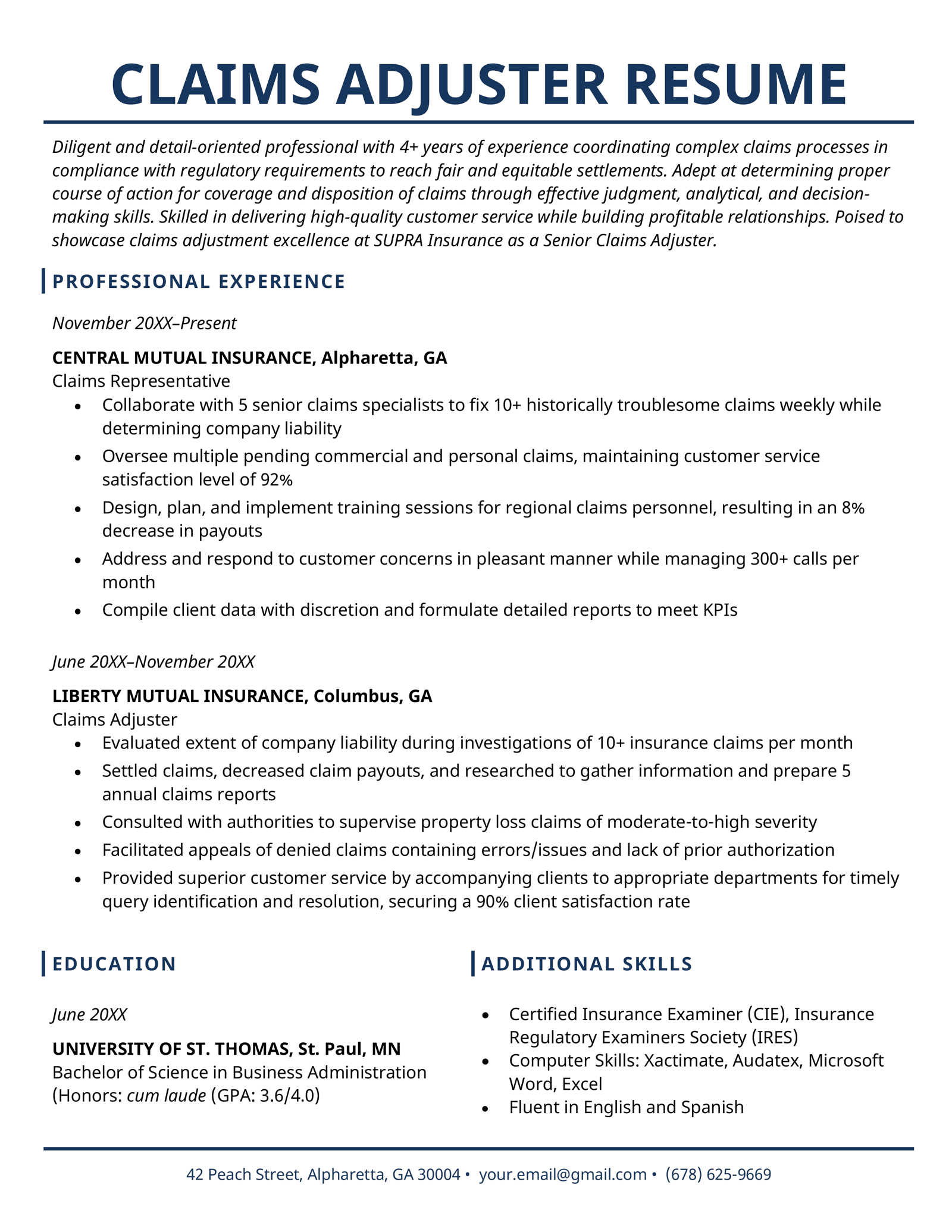

Claims Adjuster Resume Template (Text Format)

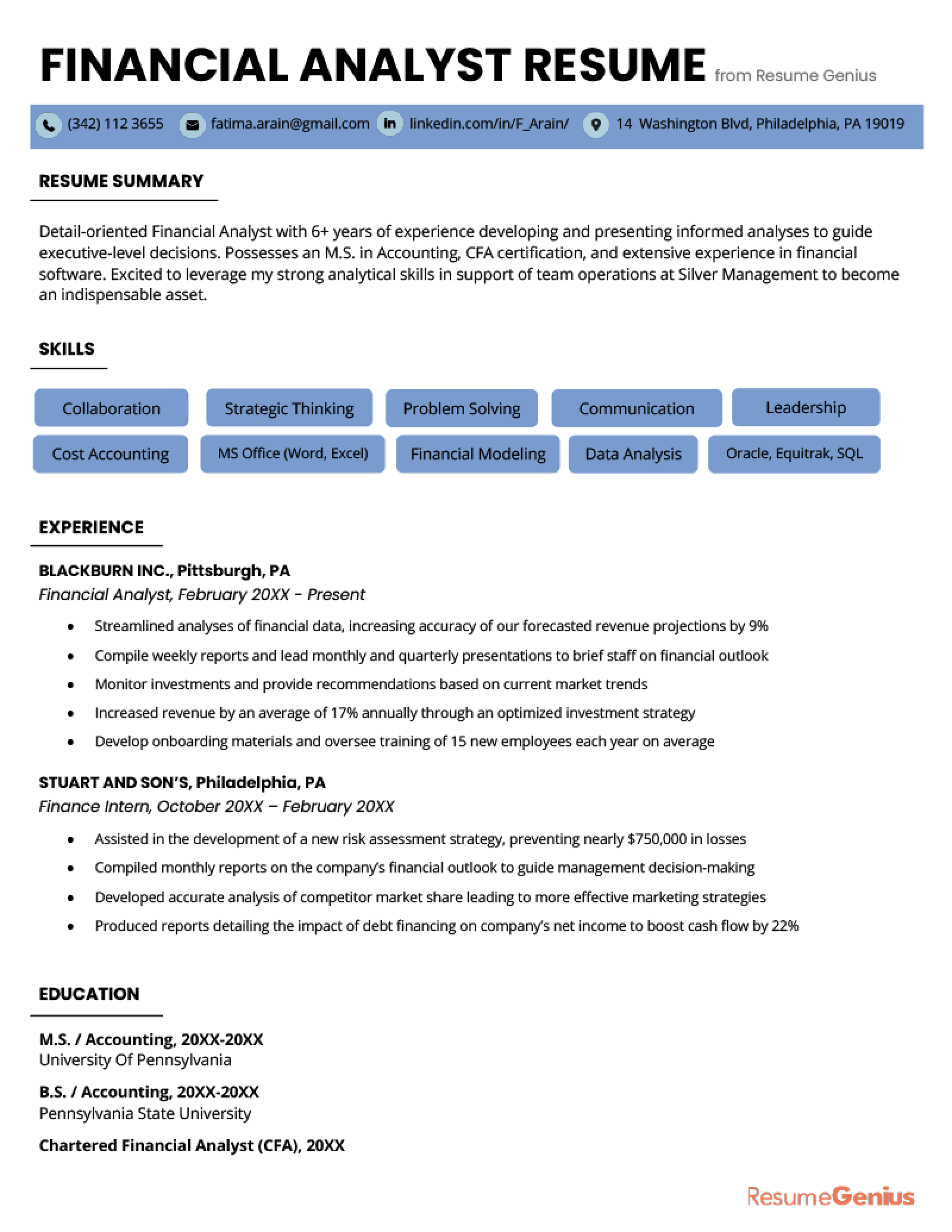

FIRST AND LAST NAME

Email: your.email@email.com

Phone: (123) 456-7891

Address: Street, City, State

LinkedIn: linkedin.com/in/yourprofile

Summary

Diligent and detail-oriented professional with 4+ years of experience coordinating complex claims processes in compliance with regulatory requirements to reach fair and equitable settlements. Adept at determining proper course of action for coverage and disposition of claims through effective judgment, analytical, and decision-making skills. Skilled in delivering high-quality customer service while building profitable relationships. Poised to showcase claims adjustment excellence at SUPRA Insurance as a Senior Claims Adjuster.

Professional Experience

Central Mutual Insurance, Alpharetta, GA

Claims Representative, November 2020–Present

- Collaborate with 5 senior claims specialists to fix 10+ historically troublesome claims weekly while determining company liability

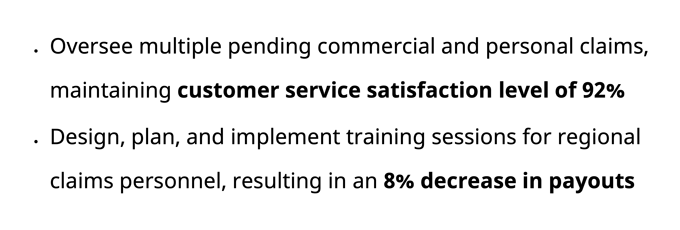

- Oversee multiple pending commercial and personal claims, maintaining customer service satisfaction level of 92%

- Design, plan, and implement training sessions for regional claims personnel, resulting in an 8% decrease in payouts

- Address and respond to customer concerns in pleasant manner while managing 300+ calls per month

- Compile client data with discretion and formulate detailed reports to meet KPIs

Liberty Mutual Insurance, Columbus, GA

Claims Adjuster, June 2018–November 2020

- Evaluated extent of company liability during investigations of 10+ insurance claims per month

- Settled claims, decreased claim payouts, and researched to gather information and prepare 5 annual claims reports

- Consulted with authorities to supervise property loss claims of moderate-to-high severity

- Facilitated appeals of denied claims containing errors/issues and lack of prior authorization

- Provided superior customer service by accompanying clients to appropriate departments for timely query identification and resolution, securing a 90% client satisfaction rate

Education

University of St. Thomas, St. Paul, MN

Bachelor of Science in Business Administration, June 2018

- Honors: cum laude (GPA: 3.6/4.0)

Additional Skills

- Certified Insurance Examiner (CIE), Insurance Regulatory Examiners Society (IRES)

- Computer Skills: Xactimate, Audatex, Microsoft Word, Excel

- Fluent in English and Spanish